Last Updated: October 23 2024

Simpro Premium 24.3.3

What's new in Simpro Premium: from 28 July 2024 AEST

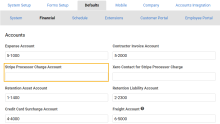

Enhanced Stripe and Xero integration in Simpro Premium

Simpro Premium now offers improved functionality for processing finance charges from Stripe to Xero. This provides you more control when managing your finances between these two integrations.

Previously when you had both Stripe and Xero integration, you would sometimes experience limitations in automatically processing charges from Stripe to Xero. Simpro now includes additional charge fields to streamline the transfer of Stripe finance charges to Xero.

Additionally, when a payment is made using Stripe, the associated processing fee will be clearly reflected in the Payment Processor Charge field within the payment record. This provides you with an easy overview of your transaction details.

Also, you can easily disconnect from Stripe when you don’t want to use it anymore.

| Read the Help Guide |

|---|

Supplier Invoice No. no longer mandatory

If inventory tracking is enabled, supplier invoice numbers were mandatory to proceed with purchase order receipts. However, as invoice numbers aren’t always available at the time of creating a receipt, this field is no longer compulsory and can be entered at a later date.

Improvements

- The invoice PDF forms displayed an incorrect VAT amount. This issue is now fixed, and now the PDF shows the same VAT amount as the original invoice.

- We fixed an issue where deleting an invoice would cause errors even after all applied payments were removed. You can now delete invoices without encountering this error.

- Modifying the service start date for an asset did not correctly update the service level date. This issue is now resolved.

- When the Sales Tax Report was grouped by invoices, retention claims would display the entire job’s tax amounts in the sales tax columns. We’ve fixed this issue so the report accurately reflects only the tax amount specific to the retention claim.

- New customer cards now populate the correct service fee as default based on the company's system setup. All fixed now.

- The Order No and Receipt No columns appeared swapped in the Transactions Ready for Export report. This is now fixed to display the columns in the correct order.

- For prepaid jobs, when the invoice applies the entire amount through the prepaid time, the overall invoice totals now accurately represent this.

- Saving a new sender Email Address in the notification wasn’t working correctly. Now, the entered email will be either saved successfully or trigger a validation warning if it's invalid.

- We’ve resolved the issue where a customer marked as On Stop in their customer card was incorrectly receiving recurring job notifications.

- The Received column in a purchase order was incorrectly showing items as received even when they are marked as not received in the receipt. We’ve made sure the Received column reflects the actual receipt status as expected.

- Viewing a specific customer's invoice history would take several minutes to load and result in either a blank page or a 503 error message. This issue is now fixed.

- Unlocking a payment and resubmitting it caused cached values to incorrectly update the invoice balance which further resulted in previously paid invoices being moved back to the unpaid list. All fixed now!

- We have fixed the issue where users were logged out when viewing attachments in grid view for certain jobs.

- In the CIS Deductions Report, downloaded CSV files for some customers were missing certain records. This issue is now resolved.

- The issue where you were not receiving feedback when the sales tax code in the cost centre breakdown table was changed is now fixed. The pencil icon will now turn green upon adjusting the sales tax code, providing a confirmation of the change.

- An SMS message of 159 characters was being charged as 2 credits. We’ve fixed this issue, so these messages will now be correctly charged as a single segment.

- We've fixed the issue where removing a PDF template from the forms setup would remove the template from the recurring invoice setup.

- The Claim breakdown table on the progress claim PDF previously included invoices with higher invoice and claim numbers. This issue is now resolved.

- An issue where the cost centre order number wouldn't transfer when merging jobs is now resolved. Now, when a cost centre has an Order No populated, it will correctly carry over to the new cost centre in the merged job.

- We've fixed an issue where removing a payment from a customer invoice wasn't reflected in the invoice log. Now, any payment removal will be correctly logged for improved tracking.

- Copying a job and changing the project to a quote resulted in the quote log incorrectly stating Copied quote from Quote xxx instead of Copied quote from Job xxx. This issue is now fixed.

- The issue in BI reporting was adding unnecessary columns and syncing unshared settings in multi-company builds. This is now resolved!

- You’ll no longer see archived jobs in your quick links when you log in to your Simpro Premium build. All fixed now!

- We’ve fixed the issue where unchecking the Finance Charge option would remove the payment details for the Square payment method.

- The issue preventing job forms from loading due to retention/retainage fields is now fixed. These fields will now function correctly, allowing forms to load and display retention amounts when a job has retention enabled.

- When setting up notifications, the Technician Name insert field was missing from SMS notification options. Now it’s back.

- When you updated a Form Builder form to make it unavailable for tax invoices, the form was also made unavailable for any recurring invoices. Now, if a form is being used in recurring invoices, you will need to remove it from those recurring invoices before you can make it unavailable for tax invoices.

- In the Transactions Ready for Export report, the Retention Held lines were being duplicated. All fixed!

- When you added a take off template to a quote or job, the tax code for the take off template was overriding the material or labour tax code defined in the project setup. Now the correct tax code will be applied.

Learning Toolbox

Get up to speed by completing a quick learning material in Simpro's Learning Toolbox.