Last Updated: December 08 2025

Reverse Charge Contractor Invoices Report - UK and IE Only

Overview

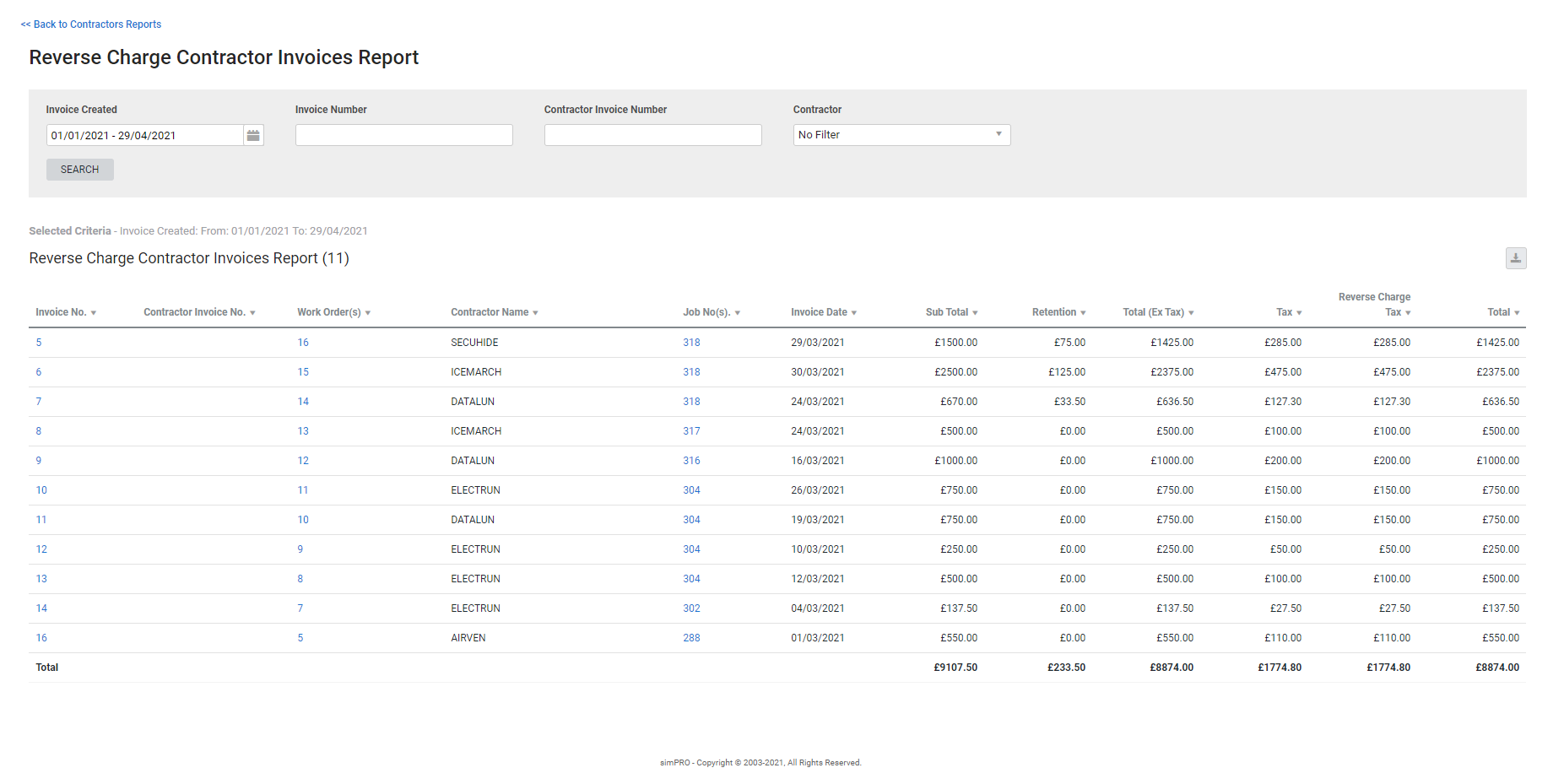

Use the Reverse Charge Contractor Invoices Report to view invoices with reverse charge arranged by each work order invoice in a specified date range. This report can be used to determine the amounts of reverse tax for tax recording purposes. Only contractor invoices generated for VAT and CIS registered contractors are displayed.

Run the report

Run the report

To run the report:

- Go to Reports

> View Reports.

> View Reports. - Go to Contractors > Reverse Charge Contractor Invoices.

- Enter a date range in the Invoice Created field.

- Enter a specific Invoice Number, Contractor Invoice Number or select a specific Contractor, as required.

- Click Search.

The customer invoices that contain reverse charge tax are displayed in the table.

Columns

Columns

The following columns are displayed in the report.

| Invoice No. | The invoice number assigned in Simpro Premium. Click to open the invoice. |

| Contractor Invoice No(s). | Click the contractor invoice number to open the contractor invoice. |

| Work Order(s) | Click the work order number to open the work order. |

| Contractor Name | The name of the contractor on the work order. |

| Job | The job number and name assigned in Simpro Premium. Click to open the job. |

| Invoice Date | The date the invoice was issued. |

| Sub Total | The Sub Total of the job. |

| Retention | The retention value of the invoice. |

| Total (Ex Tax) | The total amount on the invoice, excluding tax. |

| Tax | The tax amount applied to the job. |

| Reverse Charge Tax | The amount of reverse charge tax applied. |

| Total | The invoice total, including tax. |

Download the report as a CSV file

Download the report as a CSV file

You can download the information in the report as a spreadsheet in CSV format, viewable in Microsoft Excel and other spreadsheet software.

To download the report:

- Generate the report as required.

- Click the

icon in the top right, then click CSV.

icon in the top right, then click CSV. - View, print or save the CSV, as required.