Last Updated: December 08 2025

Reverse Charge Customer Invoices Report - UK and IE Only

Overview

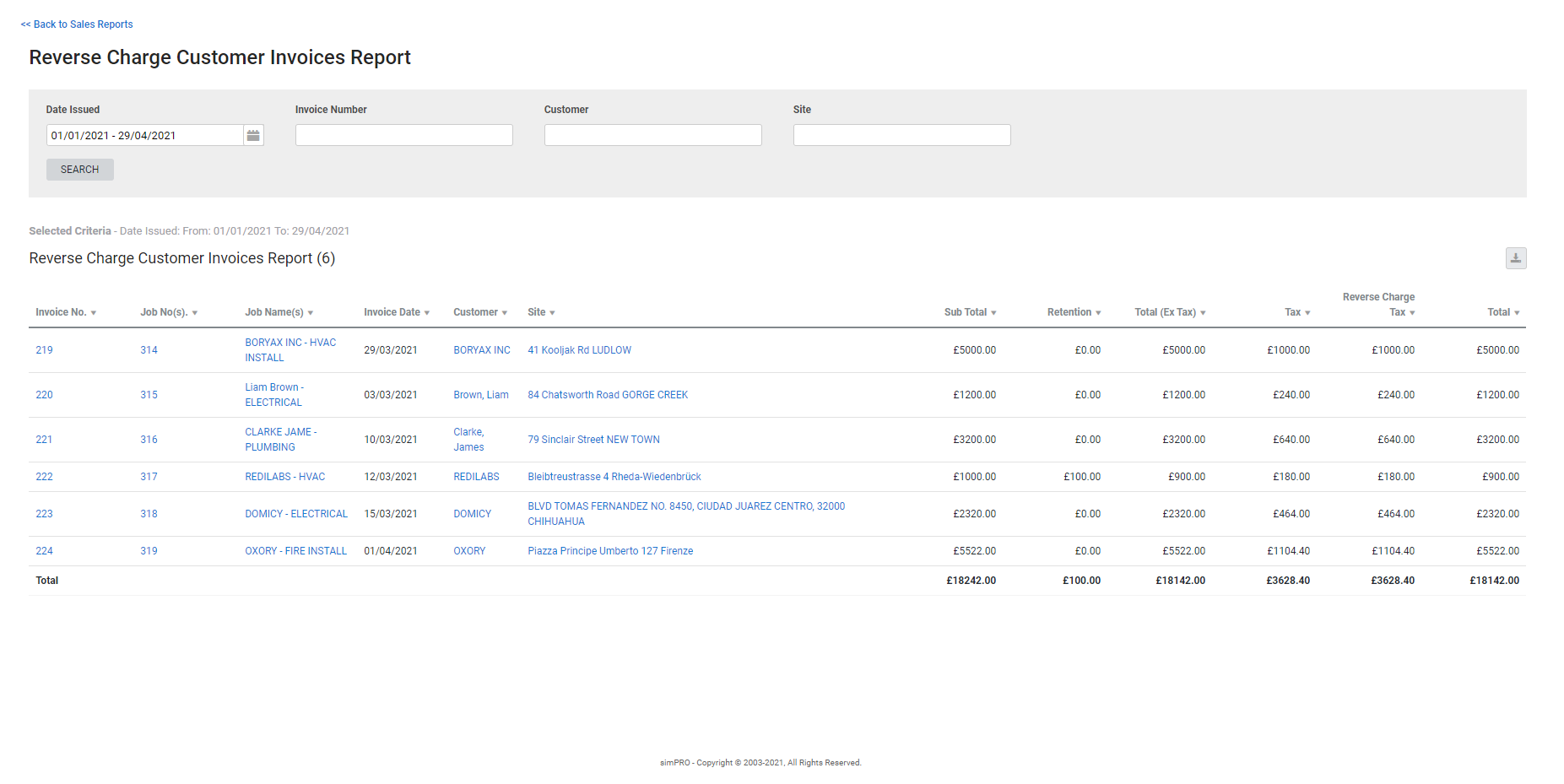

Generate a report to see how much reverse charge tax was applied to customer invoices over a set period. This is useful for verifying and reconciling reverse charge VAT between Simpro Premium and your accounting package.

Run the report

Run the report

To run the report:

- Go to Reports

> View Reports.

> View Reports. - Go to Sales > Reverse Charge Customer Invoices.

- Enter a date range in the Date Issued field.

- Enter a specific Invoice Number, Customer name or select a specific Customer or Site required.

- Click Search.

The customer invoices that contain reverse charge tax are displayed in the table.

Columns

Columns

The following columns are displayed in the report.

| Invoice No. | The invoice number assigned in Simpro Premium. Click to open the invoice. |

| Job | The job number and name assigned in Simpro Premium. Click to open the job. |

| Invoice Date | The date the invoice was issued. |

| Customer |

The customer associated with the invoice. Click to open the customer card file. |

| Site |

The site associated with the invoice. Click to open the site card file. |

| Sub Total | The Sub Total of the job. |

| Retention | The retention value of the invoice. |

| Total (Ex Tax) | The total amount on the invoice, excluding tax. |

| Tax | The tax amount applied to the job. |

| Reverse Charge Tax | The amount of reverse charge tax applied. |

| Total | The invoice total, including tax. |

Download the report as a CSV file

Download the report as a CSV file

You can download the information in the report as a spreadsheet in CSV format, viewable in Microsoft Excel and other spreadsheet software.

To download the report:

- Generate the report as required.

- Click the

icon in the top right, then click CSV.

icon in the top right, then click CSV. - View, print or save the CSV, as required.