Last Updated: December 08 2025

Overview

If you do business with sub-contractors in the UK, you can generate the CIS![]() UK only: Construction Industry Scheme - contractors register and apply tax deduction rates to customer and / or sub-contractor invoices. Monthly Returns report for information you need to file your monthly returns with HM Revenue and Customs (HMRC). You can also print and save a CIS Payment and Deduction Statement to provide each sub-contractor with a summary of the money you deducted and paid to HMRC.

UK only: Construction Industry Scheme - contractors register and apply tax deduction rates to customer and / or sub-contractor invoices. Monthly Returns report for information you need to file your monthly returns with HM Revenue and Customs (HMRC). You can also print and save a CIS Payment and Deduction Statement to provide each sub-contractor with a summary of the money you deducted and paid to HMRC.

The report can include information on total payments, amounts liable, amounts deducted, and amounts payable (including and excluding VAT). You may wish to regularly generate the report to reconcile CIS amounts with those in your accounting package.

This article only provides instructions for using the CIS features in Simpro Premium, and should not be interpreted as legal or financial advice. Learn more about CIS in How to Manage CIS / RCT with Simpro Premium - UK, IE Only, or read about your CIS obligations on the UK Government's CIS website.

If your business operates in Ireland, this report is called RCT Deductions, but functions in the same way.

Learn about other Contractor reports in Contractor Reports.

Required setup

Required setup

In order to view content or perform actions referred to in this article you need to have the appropriate permissions enabled in your security group. Go to System![]() > Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

> Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

Run the CIS Monthly Returns report

Run the CIS Monthly Returns report

To view the report:

- Go to Reports

> View Reports > Contractors > CIS Monthly Returns.

> View Reports > Contractors > CIS Monthly Returns. - Use the date picker to select a Contractor Invoice Date Range.

- Select whether you want to view the report Type as a Summary or a Breakdown.

- Select options from the other filters as required.

- Click Search.

Use report filters

Use report filters

Use the report filters to make your report as specific as you require. The filters include:

| Date Based On | Select whether you want to view results by the Date Paid or Date Created. The Date Paid option is only useful if you record contractor invoice payments in Simpro Premium. |

| Contractor Invoice Date Range | Use the date picker in this filter to select the invoice date range. This filter is mandatory. |

| Paid / Unpaid | Select whether you want to view Paid Invoices or Unpaid Invoices. This filter is only useful if you record contractor invoice payments in Simpro Premium. This is important to record, as CIS is only due after invoices have been paid and not when they are raised. |

| Type |

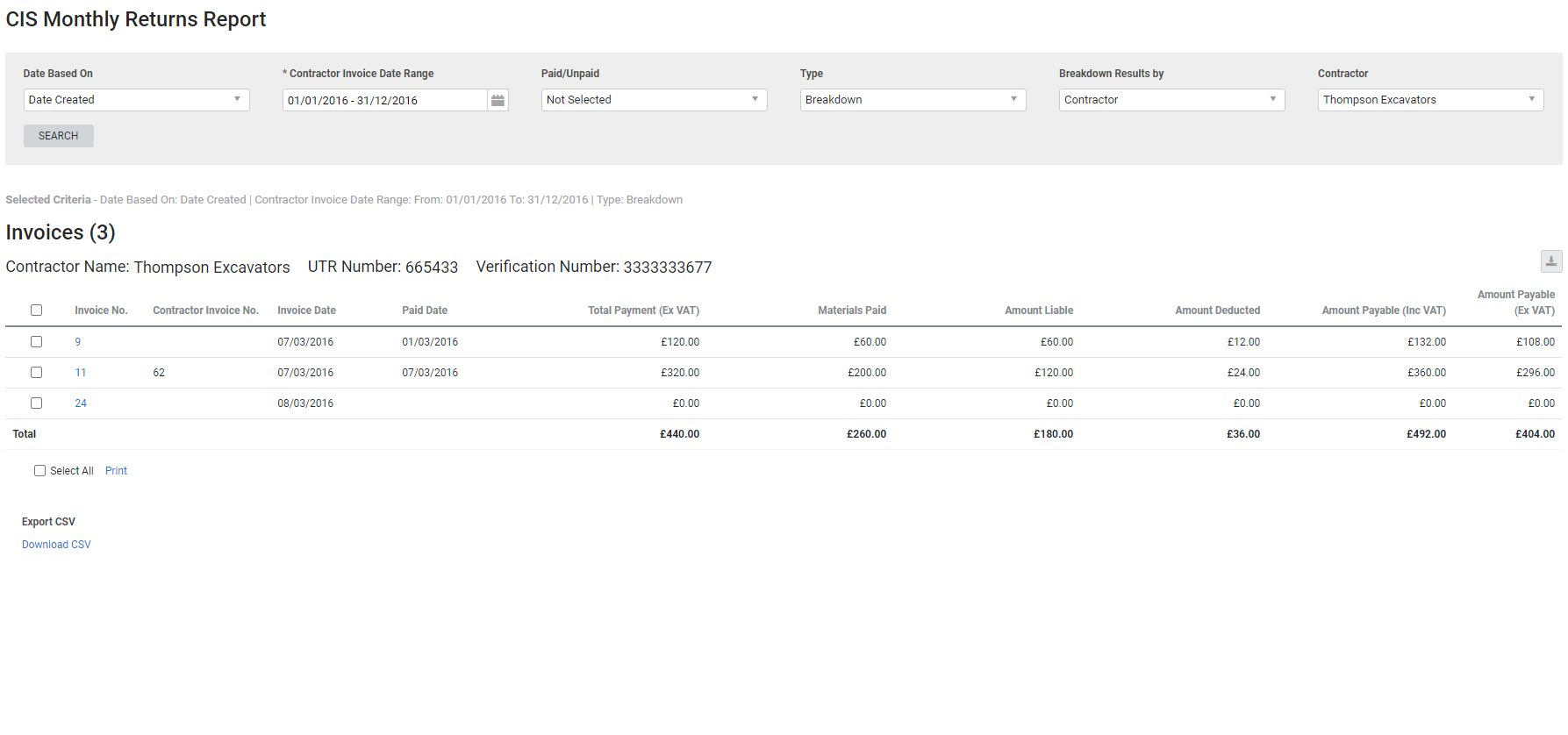

Select whether you want to view the report as a Summary or a Breakdown. If you view the report as a Breakdown, invoices for the selected date range are grouped by contractor. For each invoice you see an Invoice Date, Paid Date (if applicable), Total Payment (Ex VAT), Materials Paid, Amount Liable, Amount Deducted, Amount Payable (Inc VAT) and Amount Payable (Ex VAT). The Total of these figures appears at the bottom of each contractor's table. If you view the report as a Summary, a summary of information for each contractor is displayed, including UTR Number, Verification Number, Total Payments (Ex VAT), Materials Paid, Amount Liable, Amount Deducted and Amount Payable (Ex VAT). |

| Breakdown Results by | Select Contractor to view results grouped by contractors, or select Contractor Contact to view results grouped by contractor contacts. |

| Contractor / Contractor Contact | Select the contractor(s) or contractor contact(s) whose information you want included in the report. |

Columns

Columns

The following columns are displayed in the report:

Summary

Summary

The following columns are displayed when Summary is selected:

| Contractor Name | The name of the contractor. |

| UTR Number | The contractor's UTR number entered in their card file. |

| Verification Number | The contractor's Verification Number entered in their card file. |

| Total Payments (Ex VAT) | The total amount paid to the contractor across all invoices within the date range, excluding tax. |

| Materials Paid | The amount of materials on the contractor invoice. |

| Amount Liable | The amount of labour on the contractor invoices, liable for CIS deductions. |

| Amount Deducted | The amount deducted from invoices for CIS. |

| Amount Payable (Ex VAT) | The Total Payments (Ex VAT) minus the Amount Deducted. |

Breakdown

Breakdown

The following columns are displayed when Breakdown is selected:

| Invoice No. | The invoice number generated in Simpro Premium. Click to open the invoice. |

| Contractor Invoice No. | The actual contractor invoice number as mentioned in the Details tab in the contractor invoice. |

| Invoice Date | The invoice date selected on the contractor invoice. |

| Paid Date | The Date Paid selected on the contractor invoice. |

| Total Payment (Ex VAT) | The total value of the invoice, excluding tax. |

| Materials Paid | The amount of materials on the contractor invoice. |

| Amount Liable | The amount of labour on the contractor invoice, liable for CIS deductions. |

| Amount Deducted | The amount deducted for CIS. |

| Amount Payable (Inc VAT) | The sum of Materials Paid, Amount Liable, and VAT, minus Amount Deducted. |

| Amount Payable (Ex VAT) | The Total Payment (Ex VAT) minus Amount Deducted. |

Print a CIS Payment and Deduction Statement

Print a CIS Payment and Deduction Statement

To print a CIS Payment and Deduction Statement:

- Generate the CIS Monthly Returns report as required.

- Select the check boxes of the information you wish to print, or click Select All at the bottom of the page.

- At the bottom of the page, click Print.

- Save or print as required.

Download the report as a CSV file

Download the report as a CSV file

You can download the information in the report as a spreadsheet in CSV format, viewable in Microsoft Excel and other spreadsheet software.

To download the report:

- Generate the report as required.

- Click the

icon in the top right, then click CSV.

icon in the top right, then click CSV. - View, print or save the CSV, as required.

To download a CSV of specific report results, select the result check boxes when viewing the report as a Breakdown, then click Download CSV at the bottom of the screen.