Last Updated: December 08 2025

Overview

If you do business in the UK, you can use Simpro Premium to apply Contractor Industry Scheme (CIS![]() UK only: Construction Industry Scheme - contractors register and apply tax deduction rates to customer and / or sub-contractor invoices.) deduction rates to contractor and customer invoices.

UK only: Construction Industry Scheme - contractors register and apply tax deduction rates to customer and / or sub-contractor invoices.) deduction rates to contractor and customer invoices.

This article only provides instructions for using the CIS features in Simpro Premium, and should not be interpreted as legal or financial advice. Consult the UK Government website for information on your CIS obligations.

If your business operates in Ireland, CIS is called RCT, but functions in the same way.

Required setup

Required setup

In order to view content or perform actions referred to in this article you need to have the appropriate permissions enabled in your security group. Go to System![]() > Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

> Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

Set up CIS in Simpro Premium

Set up CIS in Simpro Premium

Before you can use Simpro Premium's CIS-related features, you must first enable them, then enter some important details.

Enable CIS features

Enable CIS features

To enable CIS in Simpro Premium:

- Go to System

> Setup > Defaults > Extensions.

> Setup > Defaults > Extensions. - Under System Extensions > CIS, select On.

- Click Save.

Enter CIS account numbers and deduction rate

Enter CIS account numbers and deduction rate

The CIS Tax Suffered Account relates to sales invoices, and the CIS Liability Account relates to contractors.

To enter your CIS account numbers and deduction rate:

- Go to System

> Setup > Defaults > Financial.

> Setup > Defaults > Financial. - Under Accounts, enter the CIS Tax Suffered Account and CIS Liability Account numbers from your accounting package.

- Under Invoicing, select the applicable CIS Deduction Rate from the drop-down list. This selection becomes the system default, but you can manually change it if necessary.

- Click Save.

Ensure your company details are accurate

Ensure your company details are accurate

Before using the CIS features in Simpro Premium, ensure your company details are accurate.

To check your company details:

- Go to System

> Setup > Company.

> Setup > Company. - Update any necessary fields, particularly your UTR #.

- Click Save.

Learn more in How to Set Up Company Information.

Enter a contractor's UTR number

Enter a contractor's UTR number

You may have entered the UTR number when creating the contractor's card file. Each contractor needs to have this number recorded in their card files.

To enter a contractor's UTR number:

- Open the contractor's card file, or create a new one.

- Go to Profile > Details.

- Enter the contractor's UTR Number.

- Click Save and Finish.

Learn more in How to Create Contractors.

Assign a CIS deduction rate to a contractor

Assign a CIS deduction rate to a contractor

You can assign a CIS deduction rate to an individual contractor, and that rate automatically applies. You can still manually adjust this rate if required.

To assign a CIS deduction rate to a specific contractor:

- Open the contractor's card file, or create a new one.

- Go to the Rates tab.

- Select the applicable CIS Deduction Rate from the drop-down list.

- Click Save and Finish.

Apply a CIS deduction rate to a contractor invoice

Apply a CIS deduction rate to a contractor invoice

To apply a CIS deduction rate to a contractor invoice:

- Invoice a contractor work order as usual.

- CIS Deduction appears in the pricing breakdown below. If the contractor has a CIS deduction rate assigned to their card file, it applies here. You can manually edit this value if required.

- Complete the invoice as usual.

Learn more in How to Manage Contractor Invoices.

Contractor invoices and your accounting package

Contractor invoices and your accounting package

When you create a contractor invoice, the invoice does not appear in your accounting link to send to your accounting package unless you enter a Contractor Invoice No. Once you have entered this number and clicked Save or Finish, the invoice appears in your accounting link, regardless of whether it has been paid or not.

Apply a CIS deduction rate to a customer invoice

Apply a CIS deduction rate to a customer invoice

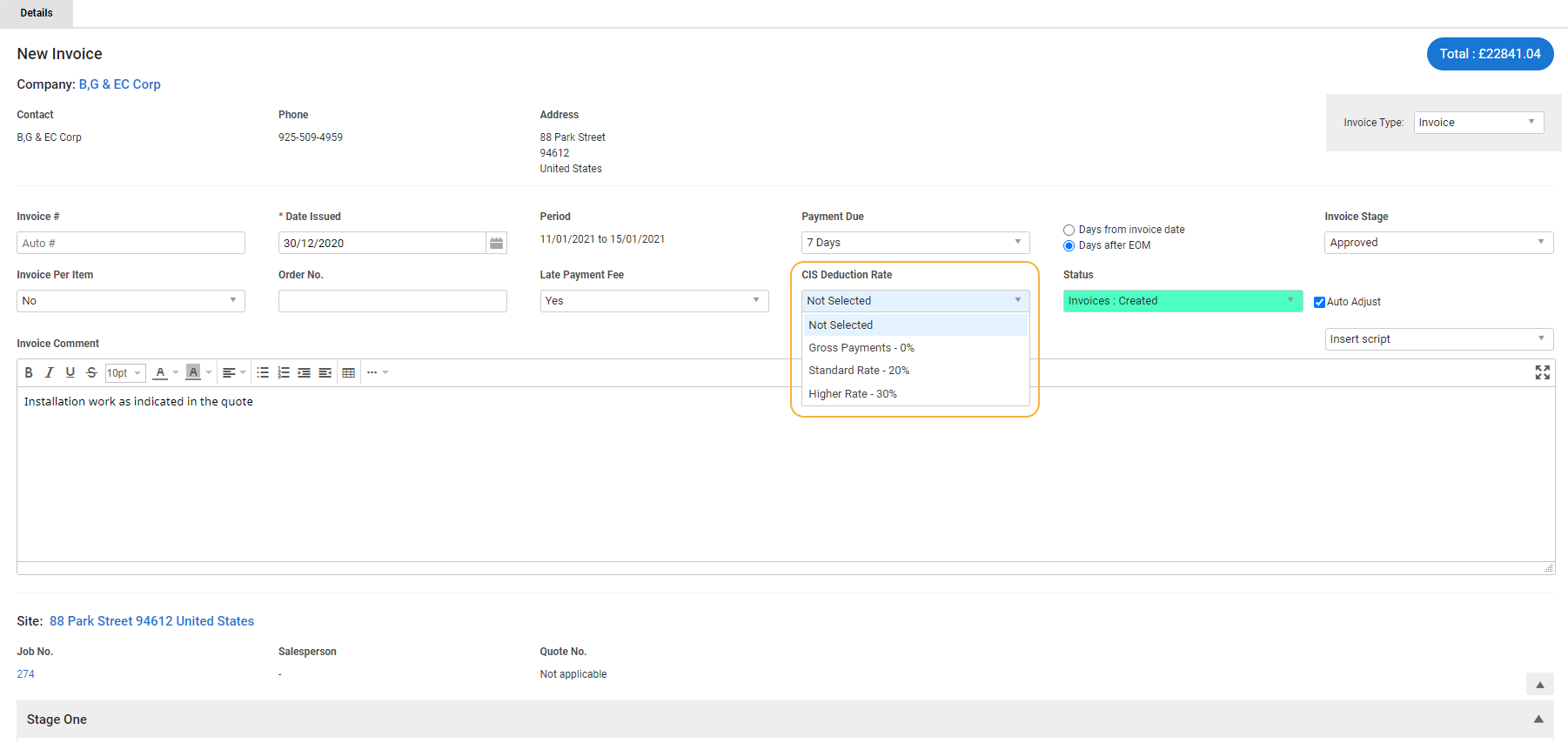

To apply a CIS deduction rate to a customer invoice:

- Create an invoice as usual.

- Select the applicable rate from the CIS Deduction Rate drop-down list.

- Less CIS Deduction appears in the pricing breakdown below. You can manually edit the value if required.

- Complete the invoice as usual.

CIS deductions against customer invoices go through to your accounting package as credit notes. This reduces the liability of the customer and shows what money has been withheld.

Always deduct CIS for a specific customer

Always deduct CIS for a specific customer

If you need to always deduct CIS on all quotes and jobs for a specific customer, you can select this option on the customer's card file. If this is selected, you do not need to select a CIS Deduction Rate when creating an invoice for this customer, and the standard CIS deduction rate is automatically applied. You can still manually adjust this rate if required.

To assign a CIS deduction rate to a specific customer:

- Open the customer's card file, or create a new one.

- Go to the Rates tab.

- Under Always Deduct CIS?, select Yes. The default CIS deduction rate is used for this customer's invoices.

- Click Save and Finish.

Bulk invoice contractors

Bulk invoice contractors

- Go to Jobs

> Contractor Jobs > Pending / Approved / Complete.

> Contractor Jobs > Pending / Approved / Complete. - Select the work orders to be invoiced or click Select All.

- Click Create Invoice.

- If the contractors are set up with different CIS rates, a warning advises you to invoice individually.

- Select Invoice Values.

- Select Invoice Type.

- Enter the Contractor Invoice No. and select the Invoice Date.

- The invoice posts to your accounting link only when it has a Contractor Invoice No.

- Select the Invoice Paid? check box if the invoice is paid in your accounting package, and then select the Date Paid.

- Contractor invoices are posted to the Default Account entered in your financial defaults. For each work order, select a different cost centre and tax code for the work order, if required.

- Select the Complete? check box if the works are completed and you are invoicing the full amount.

- Adjust the Applied amount for each work order, if required.

- Click Add Variance to add a variance, if required.

- Enter Notes as required.

- Click Save and Finish.

How are CIS deductions calculated?

How are CIS deductions calculated?

CIS deductions are calculated based on the total labour on your invoice. The value is divided by the claim amount percentage, then multiplied by the CIS deduction rate.

For example, if the total labour value is £320.00, the claim amount percentage is 50%, and the CIS deduction rate is 20%, then the CIS deduction amount would be £32.00.

Retention applied to the invoice reduces the amount of labour being claimed, this is calculated before the CIS deduction is applied.

View reports

View reports

View CIS Deductions report

You can use the CIS / RCT Deductions Report - UK, IE Only to view CIS deducted by each customer in a specified date range.

View CIS Monthly Returns report

The CIS / RCT Monthly Returns - UK, IE Only can help provide information you need when filing your monthly report with HMRC, and you can also use it to generate a CIS Payment and Deduction Statement to send to sub-contractors.

Tips

Tips

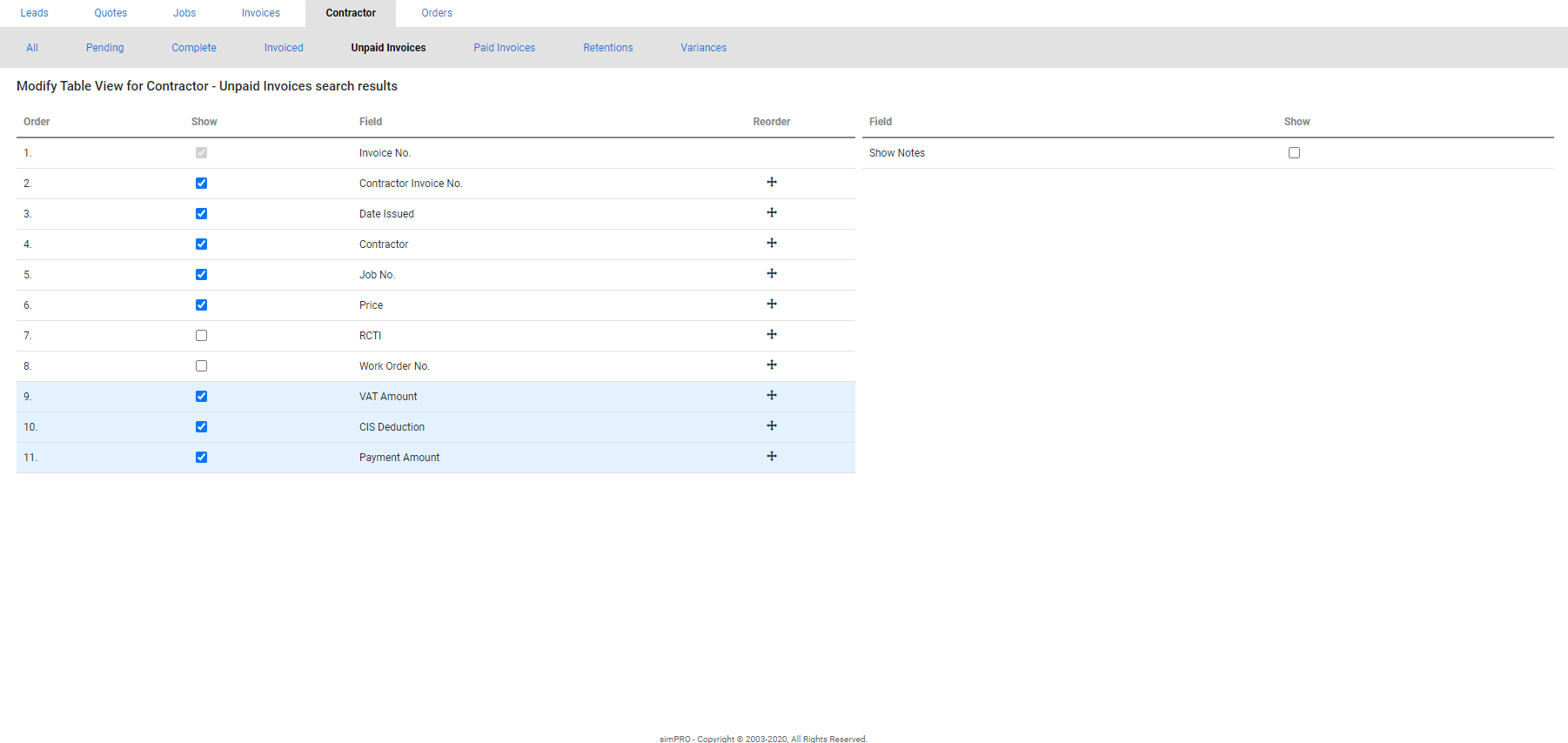

Modify table view for contractor invoices

You can modify your table view in Contractor Unpaid Invoices and Contractor Paid Invoices to include fields for VAT Amount, CIS Deduction, Payment Amount etc.

Simply go to Invoices ![]() > Contractor Unpaid / Paid Invoices, then click Modify Table View. Select Show for the fields you wish to view, then click Finish.

> Contractor Unpaid / Paid Invoices, then click Modify Table View. Select Show for the fields you wish to view, then click Finish.

To download paid and unpaid invoice information, click the ![]() icon in the top right, then click CSV.

icon in the top right, then click CSV.