Last Updated: December 05 2025

Sales Tax Report - US only

Overview

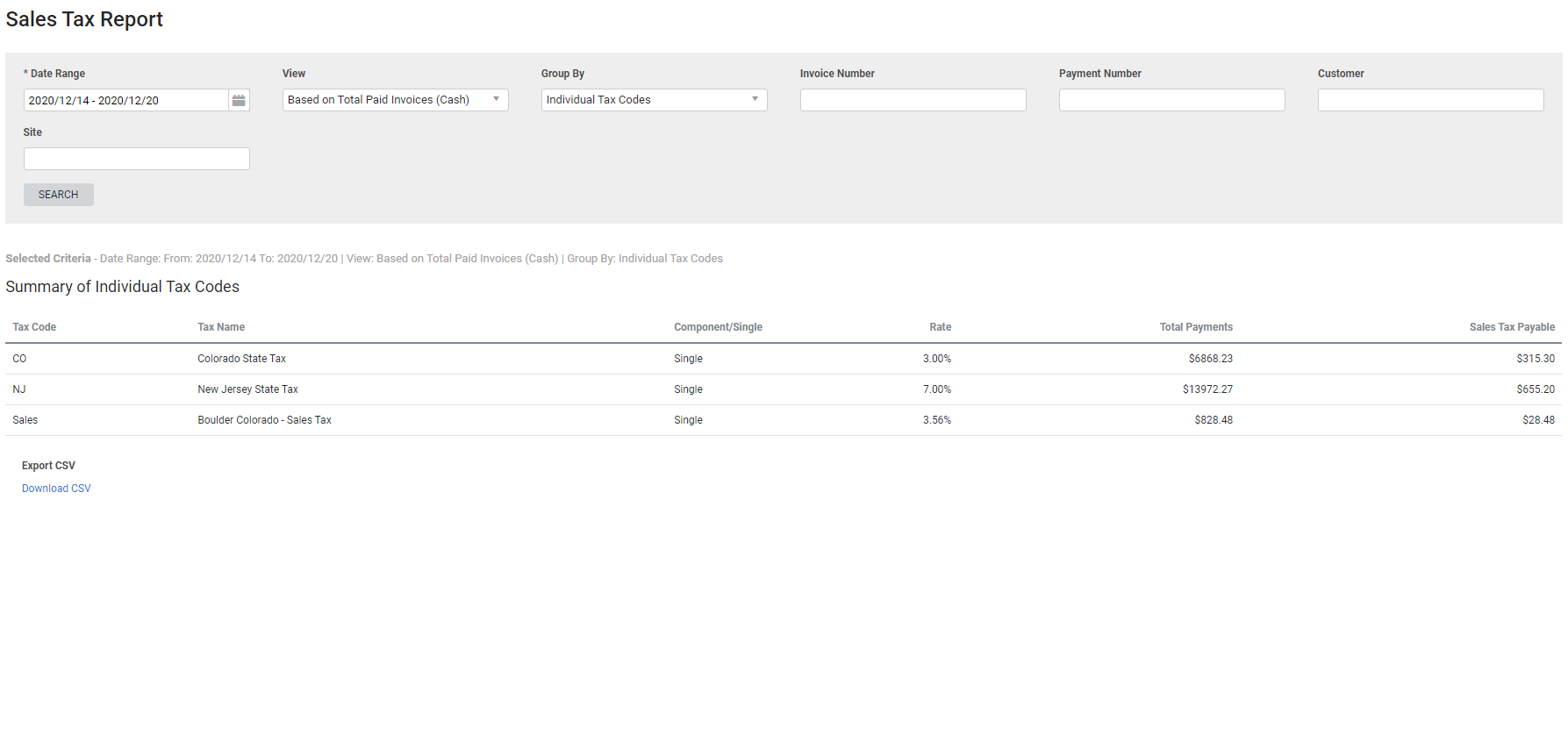

Use the Sales Tax Report to help prepare your tax filing requirements. See the breakdown of taxes applied based either on cash or accrual to help reconciling with your accounting package reporting.

Learn about other Sales reports in Sales Reports.

Required setup

Required setup

In order to view content or perform actions referred to in this article you need to have the appropriate permissions enabled in your security group. Go to System![]() > Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

> Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

Information displayed

Information displayed

The following columns are displayed for Individual Tax Codes:

| Tax Code | Name given to the tax code in System Setup. |

| Tax Name | Name given to the tax code in System Setup. |

| Component / Single | Whether the tax code is a component or single type. |

| Rate | Percentage rate of tax. |

| Total Invoiced | The total invoiced amounts for the defined tax code. Only shows if View is Based on Total Invoice Sales (Accrual). |

| Total Payments | The total payment amounts for the defined tax code. Only shows if View is Based on Total Paid Invoices (Cash). |

| Sales Tax Payable | The total sales tax payable for the defined tax code. |

The following columns are displayed for Invoices:

| Invoice No | Click to open the invoice. |

| Job No(s) | Click to open the job. |

| Payment Date | The date when the payment was made. This only displays if View is Based on Total Paid Invoices (Cash). |

| Customer | Click to open the customer card file. |

| Payments | The number of payments made, followed by the payment amount. This only displays if View is Based on Total Paid Invoices (Cash). |

| Zip Code | Zip code |

| Site Name | Click to open the site card file. |

| Total Ex Tax | The invoice total excluding tax. |

| Tax Code | Name of the tax applied to the invoice. |

| Tax Rate | The percentage of tax applied. |

| Total Ex Tax | Total of the invoice excluding tax. |

| Payment Amount | The amount paid. |

| Sales Tax Payable | The total sales tax payable for the defined tax code. |

The following columns are displayed for combined tax codes:

| Tax Code | Name given to the tax code in System Setup. |

| Tax Name | Name given to the tax code in System Setup. |

| Tax Effective Date | The date the tax rate is effective from. |

| Rate | Percentage rate of tax. |

| Total Invoiced | The total invoiced amounts for the defined tax code. Only shows if View is Based on Total Invoice Sales (Accrual). |

| Total Payments | The total payment amounts for the defined tax code. Only shows if View is Based on Total Paid Invoices (Cash). |

| Sales Tax Payable | The total sales tax payable for the defined tax code. |

Download report

Download report

To download the report, click Download CSV.