Last Updated: December 08 2025

Overview

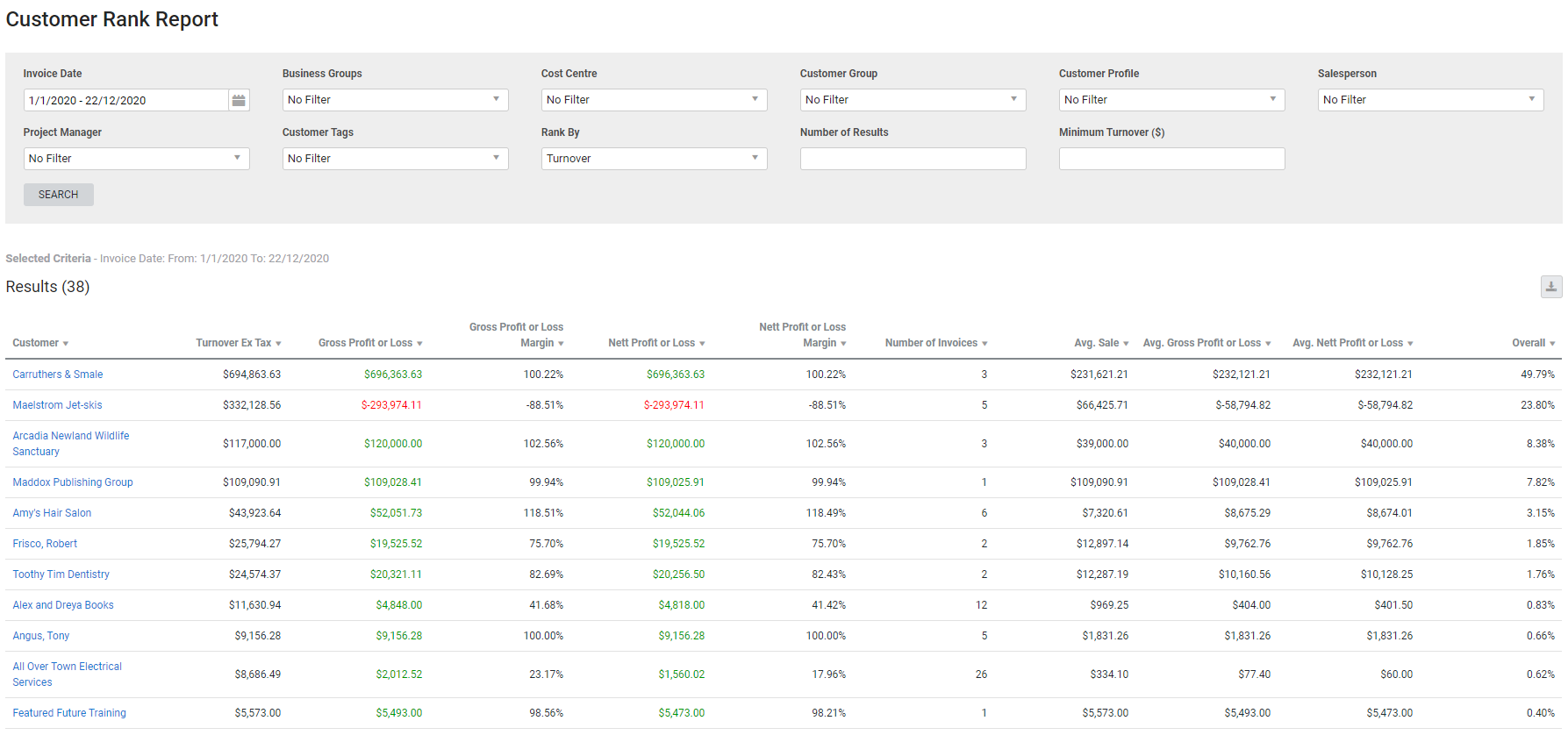

This report is useful for determining which of your customers are generating the most business, as you can rank customers by either turnover, profit, margin or average invoice value etc. within a specified date range.

The Customer Rank Report is calculated based on invoice values rather than job values. And it includes Tax Invoices, Deposits, Progress Claims and Retention Claims.

Learn about other Customer reports in Customer Reports.

Required setup

Required setup

In order to view content or perform actions referred to in this article you need to have the appropriate permissions enabled in your security group. Go to System![]() > Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

> Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

Run the Customer Rank report

Run the Customer Rank report

To view the report:

- Go to Reports

> View Reports.

> View Reports. - Click Customer > Customer Rank.

- Select the date range under Invoice Date.

- Filter the report by selecting from the Business Groups, Cost Centre, Customer Group, Customer Profile, Salesperson, Project Manager and Customer Tags drop-downs.

- Under Rank By, select how you wish to rank customers according to turnover, gross profit / loss, nett profit / loss, gross margin, nett margin, activity, average sale, average gross profit / loss, or average nett profit / loss.

- Enter the Number of Results you wish to see.

- Enter the Minimum Turnover value.

- Click Search.

Learn more in How to Use Customer Groups, How to Use Customer Profiles, How to Use Tags, and How to Use Cost Centres.

Report columns

Report columns

The following information is displayed in the report. You can click the column titles to rank customers by that criteria.

| Turnover Ex Tax |

The sub-total of all invoices created for the customer. Retention is always deducted from this value excluding tax regardless of the customer's retention setting. |

| Gross Profit or Loss |

The total gross profit or loss earned from the customer. The difference between total direct costs excluding overhead and the sub-total. If calculating Gross Profit and Loss for progress claims, the report considers the percentage claimed for each individual cost centre and applies that percentage to the Gross Profit and Loss indicated on the corresponding cost centre in the job. The report adds the values calculated from each cost centres together to calculate the final figure. Example Cost Centre 1 Percentage Claimed: 10% Cost Centre 1 Gross P / L: $100 10% of $100 = $10 Cost Centre 2 percentage claimed: 50% Cost Centre 2 Gross P / L: $200 50% of $200 = $100 Gross P / L on the Customer Rank Report: $100 + $10 = $110 If calculating Gross Profit on Loss on a claim per item invoice, the total value of the items claimed are calculated as a percentage. That percentage is then applied to the Gross Profit and Loss on the job. |

| Gross Profit or Loss Margin | The total Gross Profit or Loss as a percentage of the Turnover Ex Tax. |

| Nett Profit or Loss |

The total nett profit or loss earned from the customer. The difference between total direct costs including overhead and the sub-total. If calculating Nett Profit and Loss for progress claims, the report considers the percentage claimed for each individual cost centre and applies that percentage to the Nett Profit and Loss indicated on the corresponding cost centre in the job. The report adds the values calculated from each cost centres together to calculate the final figure. Example Cost Centre 1 Percentage Claimed: 10% Cost Centre 1 Nett P / L: $100 10% of $100 = $10 Cost Centre 2 percentage claimed: 50% Cost Centre 2 Nett P / L: $200 50% of $200 = $100 Gross P / L on the Customer Rank Report: $100 + $10 = $110 If calculating Nett Profit on Loss on a claim per item invoice, the total value of the items claimed are calculated as a percentage. That percentage is then applied to the Nett Profit and Loss on the job. |

| Nett Profit or Loss Margin | The total Nett Profit or Loss as a percentage of the Turnover Ex Tax. |

| Number of Invoices | The number of invoices, both paid and unpaid. |

| Avg. Sale | The turnover excluding tax divided by the number of invoices. |

| Avg. Gross Profit or Loss | The gross profit or loss divided by the number of invoices. |

| Avg. Nett Profit or Loss | The nett profit or loss divided by the number of invoices. |

| Overall | The customer's turnover as a percentage of the total turnover of all customers. |

Download the report as a CSV file

Download the report as a CSV file

You can download the information in the report as a spreadsheet in CSV format, viewable in Microsoft Excel and other spreadsheet software.

To download the report:

- Generate the report as required.

- Click the

icon in the top right, then click CSV.

icon in the top right, then click CSV. - View, print or save the CSV, as required.