Last Updated: December 08 2025

Overview

Due to a change in legislation, as of March 01, 2021, CIS registered construction businesses in the UK and subcontractors working for them need to account for domestic reverse charge VAT.

Reverse charge tax codes integrate with Xero and Sage.

We are currently waiting for QuickBooks to provide a viable solution for reverse charge tax. When available we will update the integration.

In the meantime if you are using QuickBooks Online or QuickBooks Desktop / Reckon, you can still manage reverse charge tax in Simpro Premium using an alternative workflow.

For updates on reverse charge VAT in QuickBooks Online, visit their website.

If you use Xero or Sage, learn more in Domestic Reverse Charge Tax - UK and IE Only.

Required setup

Required setup

In order to view content or perform actions referred to in this article you need to have the appropriate permissions enabled in your security group. Go to System![]() > Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

> Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

Create a reverse charge tax code

Create a reverse charge tax code

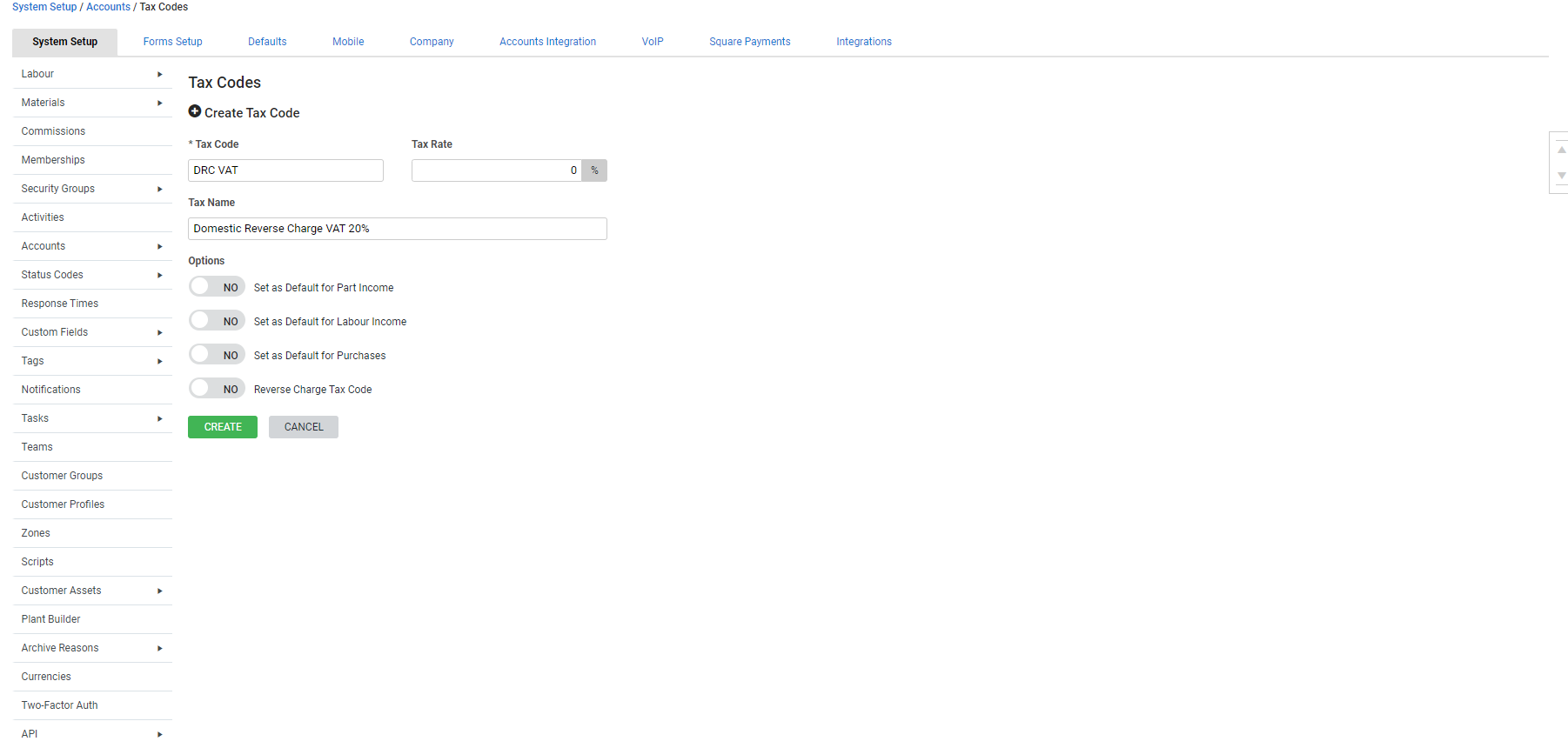

Create a tax code with a rate of zero to generate invoices and contractor invoices with the correct reverse charge VAT value.

To create a tax code for reverse charge:

- Go to System

> Setup > Accounts > Tax codes.

> Setup > Accounts > Tax codes. - Click Create Tax Code.

- Enter the Tax Code.

- Enter the Tax Rate as 0%.

- Enter the Tax Name as Reverse VAT 20%.

- Do not toggle on Reverse Charge Tax Code. This option is not compatible with QuickBooks.

- Click CREATE.

CIS and VAT registered construction business

CIS and VAT registered construction business

Depending on whether you are a CIS registered business or subcontractor being employed by a CIS registered business, determines how you need to manage the domestic reverse charge VAT. This impacts which work flows in Simpro Premium you need to adjust to account for reverse charge VAT.

As a CIS and VAT registered business, you are responsible for accounting for the VAT that previously would have been paid to your subcontractors.

The following sections apply if you are a CIS and VAT registered construction business.

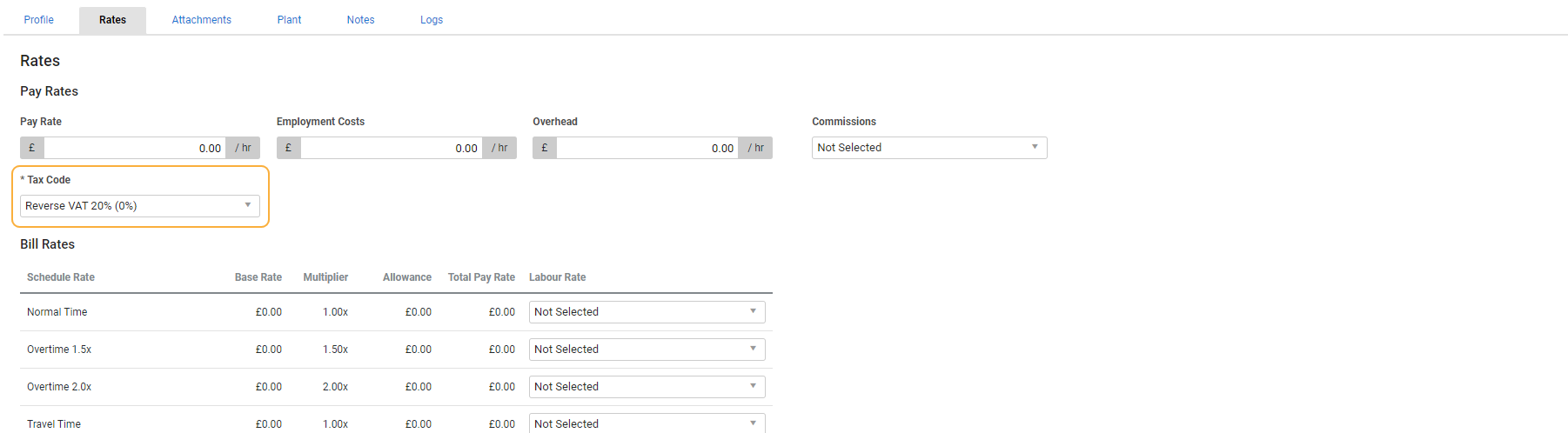

Assign reverse charge tax to a contractor work order

Assign reverse charge tax to a contractor work order

To assign the tax code created for reverse charge to a contractor job:

- Open the job that you want the work order assigned to.

- If it is a project quote / job, go to the Cost Centre List and open the relevant cost centre.

- Click Contractor.

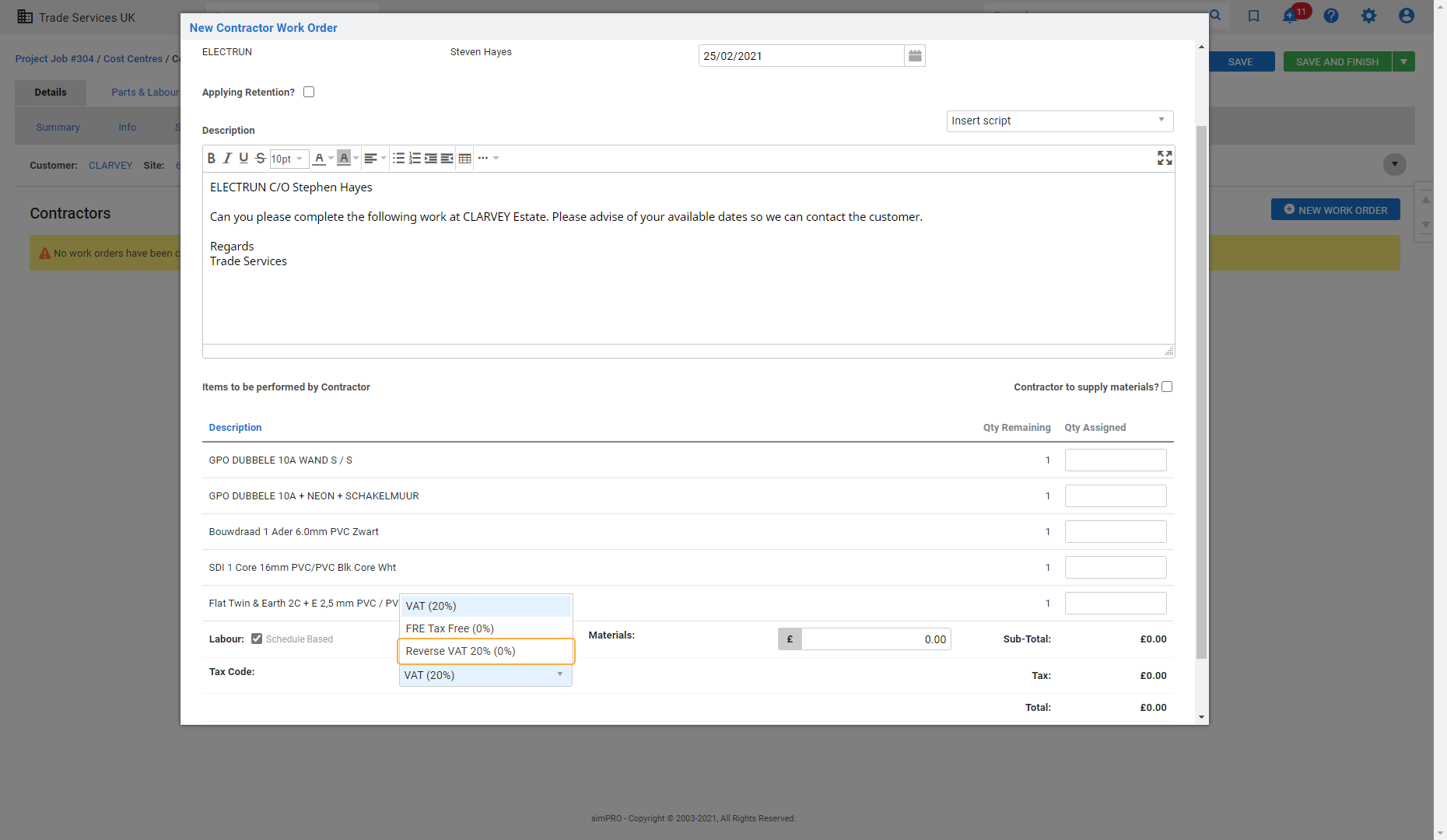

- Create a New Work Order or open the relevant contractor job.

- If you are creating a new work order, select a Contractor and Employee and add materials and labour, as required.

- Enter a note in the Description to indicate that this work order includes reverse charge tax.

- If materials are already added to the job and the contractor is providing them, select Contractor to supply materials? and update the Qty Assigned.

- Note the value of the VAT. This value becomes the domestic reverse charge VAT.

- Under the Tax Code select the tax code created for reverse charge.

- Note that if you are required to apply reverse charge VAT on some materials and labour and not others, and you are accounting for this by creating partial invoices, change the tax code on the contractor invoice rather than during this step.

- Click Save and Finish.

Invoice contractor jobs with reverse charge VAT

Invoice contractor jobs with reverse charge VAT

The same tax code must be used for the entire contractor job. You cannot select different tax codes for materials and labour or individual materials. If all the items on a work order require reverse charge VAT, you can invoice the contractor job normally.

If you are required to apply a reverse charge tax code to certain items, you can create multiple contractor jobs, some with the reverse charge tax and others without. You can then consolidate these contractor jobs into a single contractor invoice. Alternatively, you can create a single contractor work order and partially invoice it as multiple contractor invoices, with some contractor invoices including reverse charge VAT and others using standard VAT.

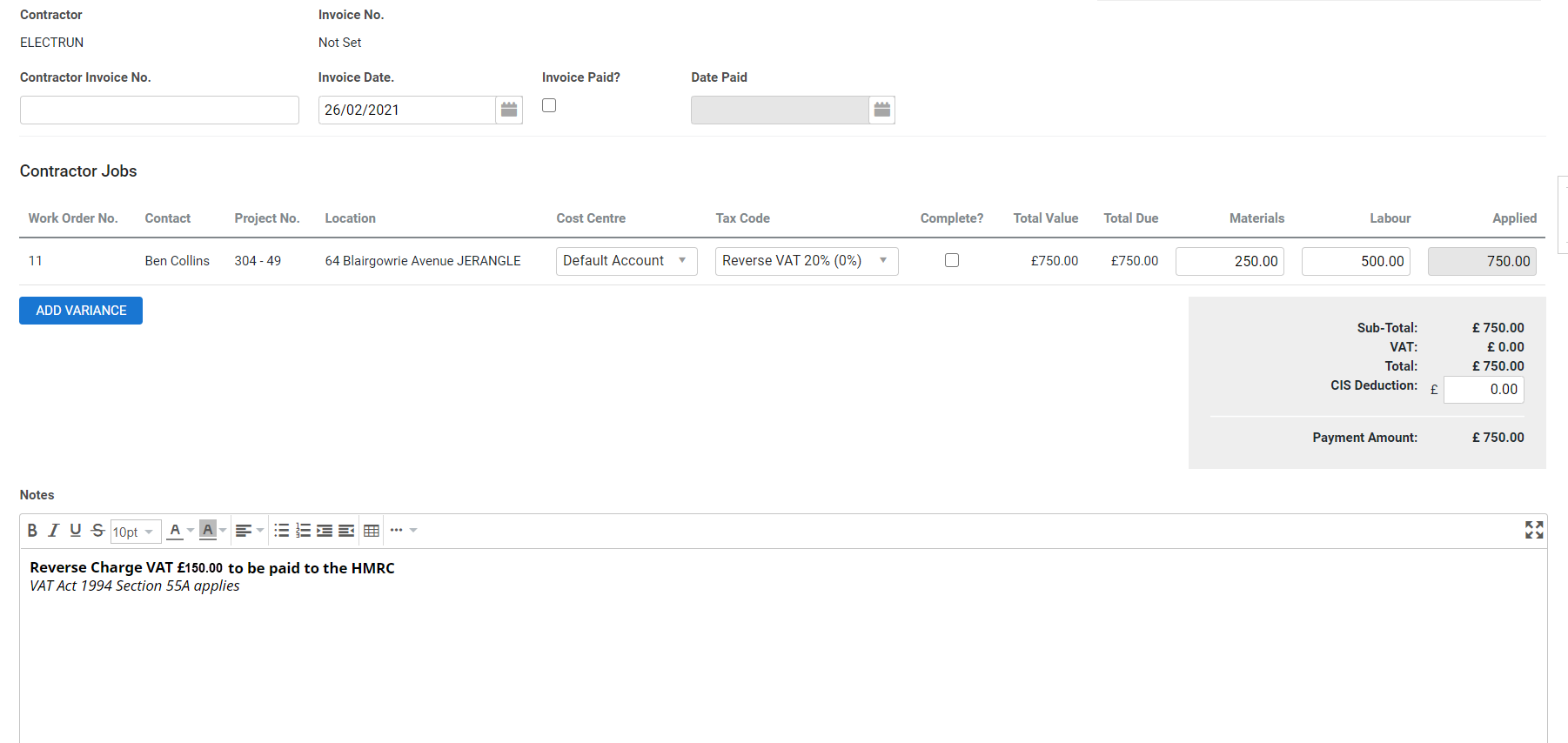

To invoice a contractor job with all items including reverse VAT:

- Go to Jobs

> Contractor Jobs.

> Contractor Jobs. - Click Options on the reverse charge VAT work order > Create Invoice.

- In the Notes section, include a reverse charge note and the value of the domestic reverse charge VAT that you noted down when creating the work order.

- For example - Reverse Charge: VAT Act 1994 Section 55A applies. £150.00 reverse charge VAT to be paid to HMRC.

- Click SAVE.

- Go to Forms and SEND the contractor invoice, as required.

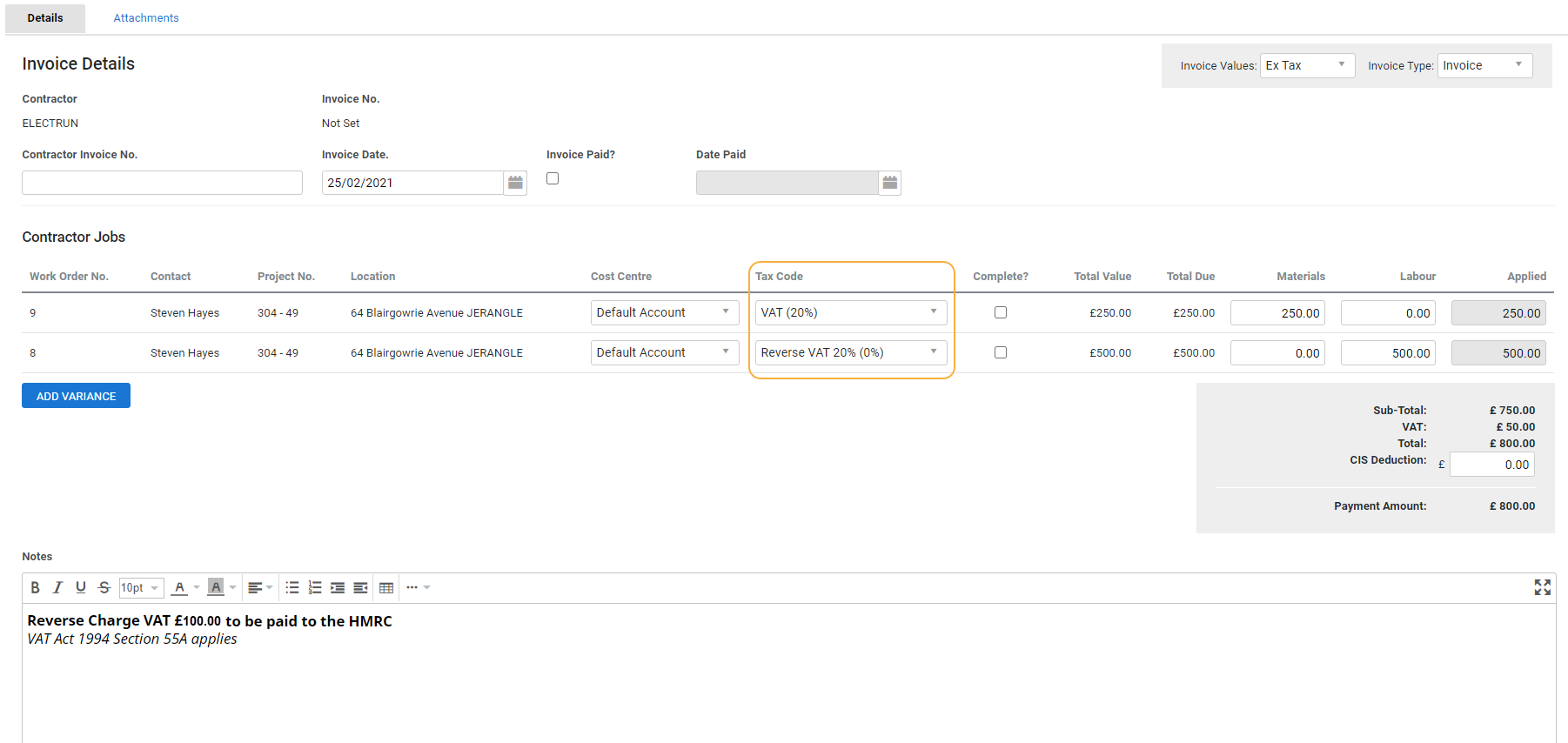

To consolidate multiple work orders into one contractor invoice:

- Go to Jobs

> Contractor Jobs.

> Contractor Jobs. - Use the check boxes to select both the contractor jobs and click Create Invoice.

- In the Notes section, include a reverse charge note and the value of the domestic reverse charge VAT that you noted down when creating the work order.

- For example - Reverse Charge: VAT Act 1994 Section 55A applies. £100.00 reverse charge VAT.

- Click SAVE.

- Go to Forms and SEND the contractor invoice as required.

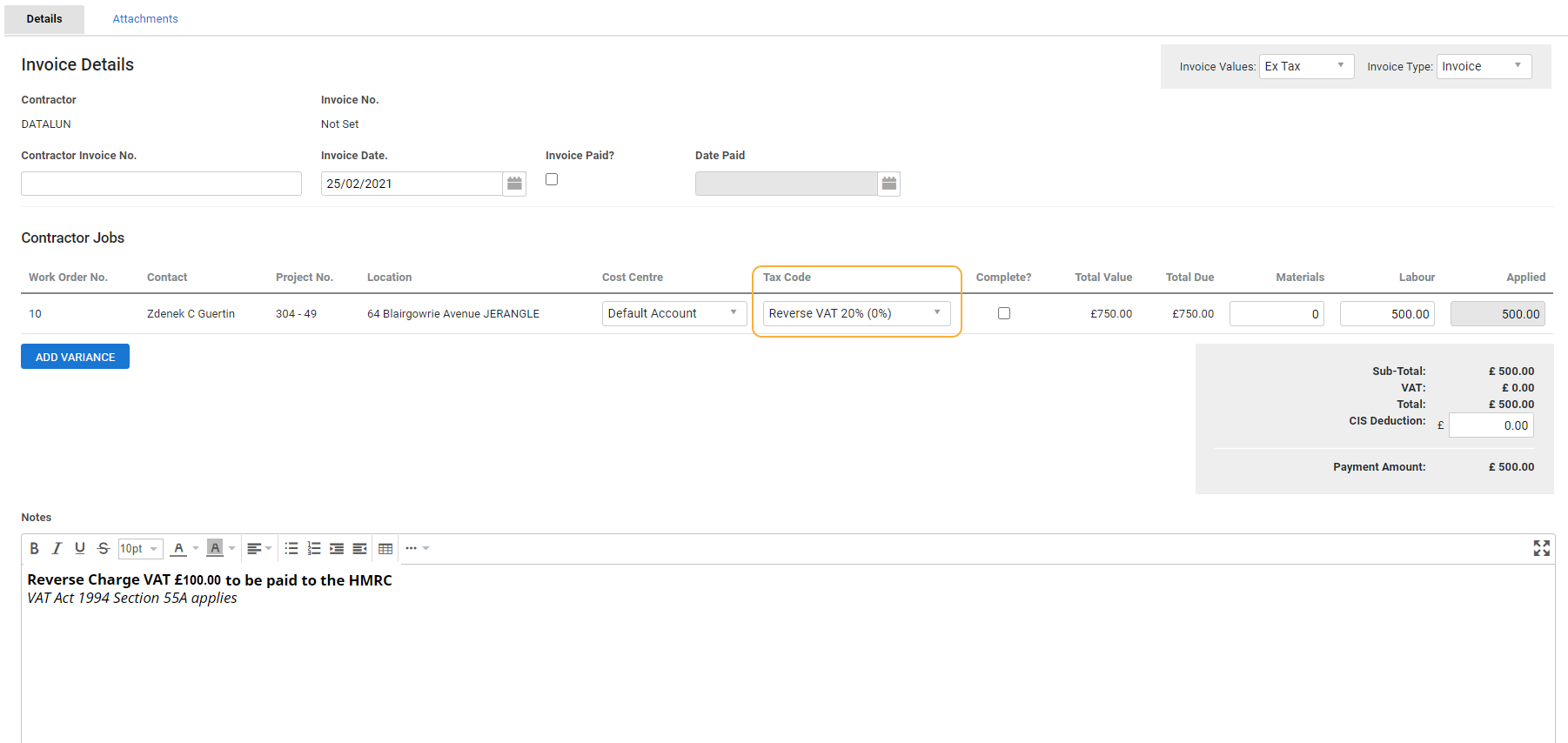

To partially invoice a work order as multiple contractor invoices:

- Go to Jobs

> Contractor Jobs.

> Contractor Jobs. - Click Options on the work order that includes reverse charge VAT > Create Invoice.

- Enter the value of the parts and labour that include reverse charge VAT in the Applied field.

- Note the value of the VAT.

- Change the Tax Code to the tax code created for reverse charge.

- In the Notes section include a reverse charge note and the value of the domestic reverse charge VAT that you noted down when creating the work order.

- For example - Reverse Charge: VAT Act 1994 Section 55A applies. £100.00 reverse charge VAT.

- Click SAVE.

- Note the Invoice number and go to Forms.

- Click VIEW.

- Click the Download icon and Save to download a copy of the PDF invoice form. Close the PDF.

- Click Save and Finish.

- Go to Jobs

> Contractor Jobs.

> Contractor Jobs. - Click Options on the partially invoiced work order and click Create Invoice.

- Enter a Contractor Invoice Number.

- Note that you cannot use the same Contractor Invoice Number as the first partial invoice. You can enter the first invoice number followed by -1, -2, -3 and so on to help identify that the invoices are linked.

- Note that you cannot use the same Contractor Invoice Number as the first partial invoice. You can enter the first invoice number followed by -1, -2, -3 and so on to help identify that the invoices are linked.

- Ensure the Tax Code is VAT.

- In the Notes section enter a reference to the invoice number noted from the reverse charge invoice.

- For example - Partial Invoice Ref: 123

- Click SAVE.

- Click Attachments and open the downloaded reverse charge VAT form.

- Select Email and click SAVE.

- Click Forms and SEND the forms, including the reverse charge VAT invoice as required.

Subcontractors working for a CIS registered construction business

Subcontractors working for a CIS registered construction business

Depending on whether you are a CIS registered business or subcontractor being employed by a CIS registered business, determines how you need to manage domestic reverse charge VAT. This impacts which workflows in Simpro Premium you need to adjust to account for the reverse charge VAT.

As a subcontractor that is contracting to a CIS, VAT registered construction business, you need to account for reverse charge VAT on your customer invoices and jobs.

The following sections apply to subcontractors work for CIS registered construction businesses.

Add reverse charge note to invoice templates

To indicate on invoice forms that domestic reverse charge VAT applies, you can add the note to the footnote of your invoice template or add the note manually to individual invoices using a script. You can also add a note to Form Builder Template and adjust them before emailing.

Examples of reverse charge notes include:

- Reverse Charge: VAT Act 1994 Section 55A applies

- Reverse Charge: S55A VATA 94 applies

- Reverse Charge: Customer to pay the VAT to HMRC

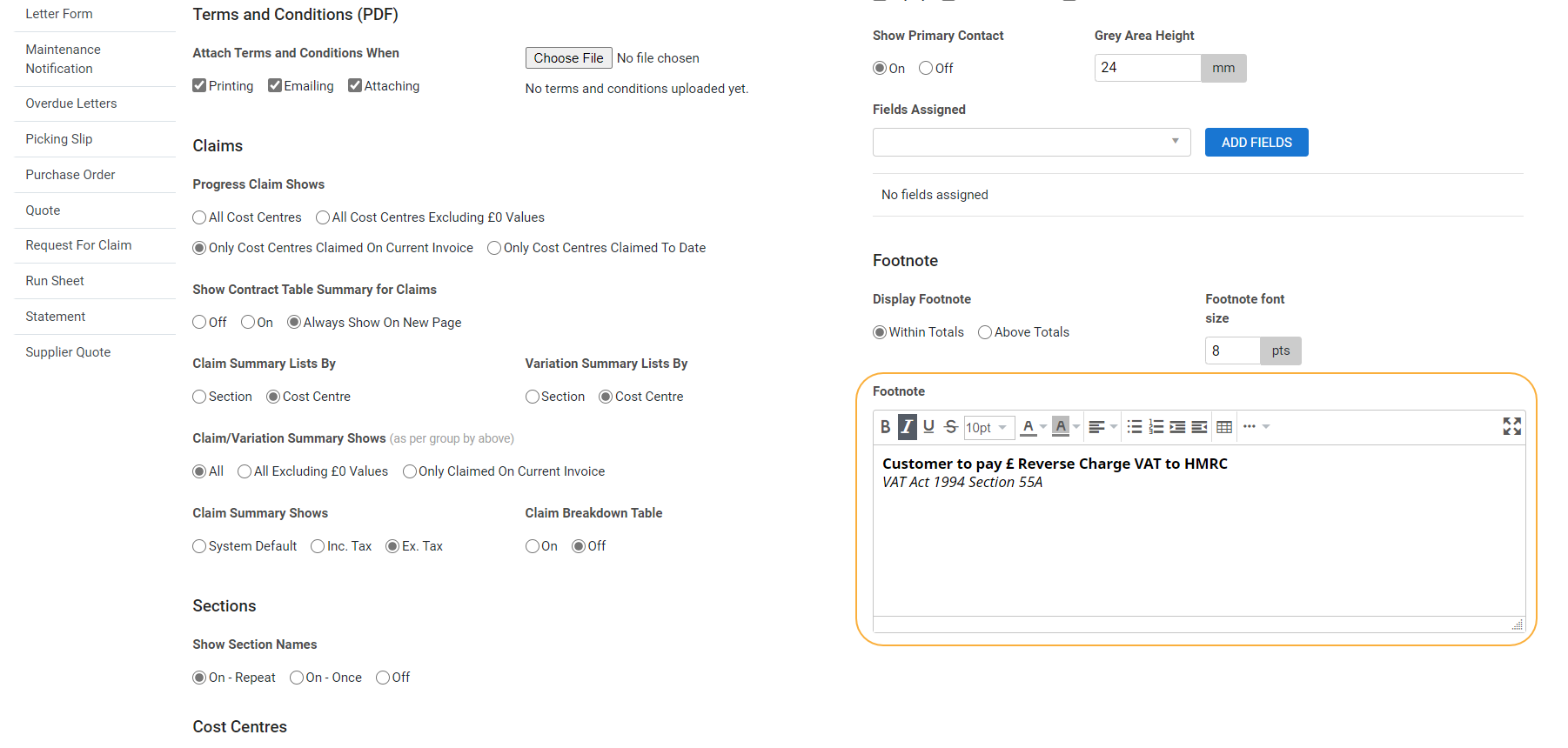

To add a reverse charge note to the footnote of all PDF invoices:

- Go to System

> Setup > Form Setup > Invoice > PDF Templates > Display Options > Footnote.

> Setup > Form Setup > Invoice > PDF Templates > Display Options > Footnote. - Enter the note.

- For example - Reverse Charge: VAT Act 1994 Section 55A applies.

- Click SAVE.

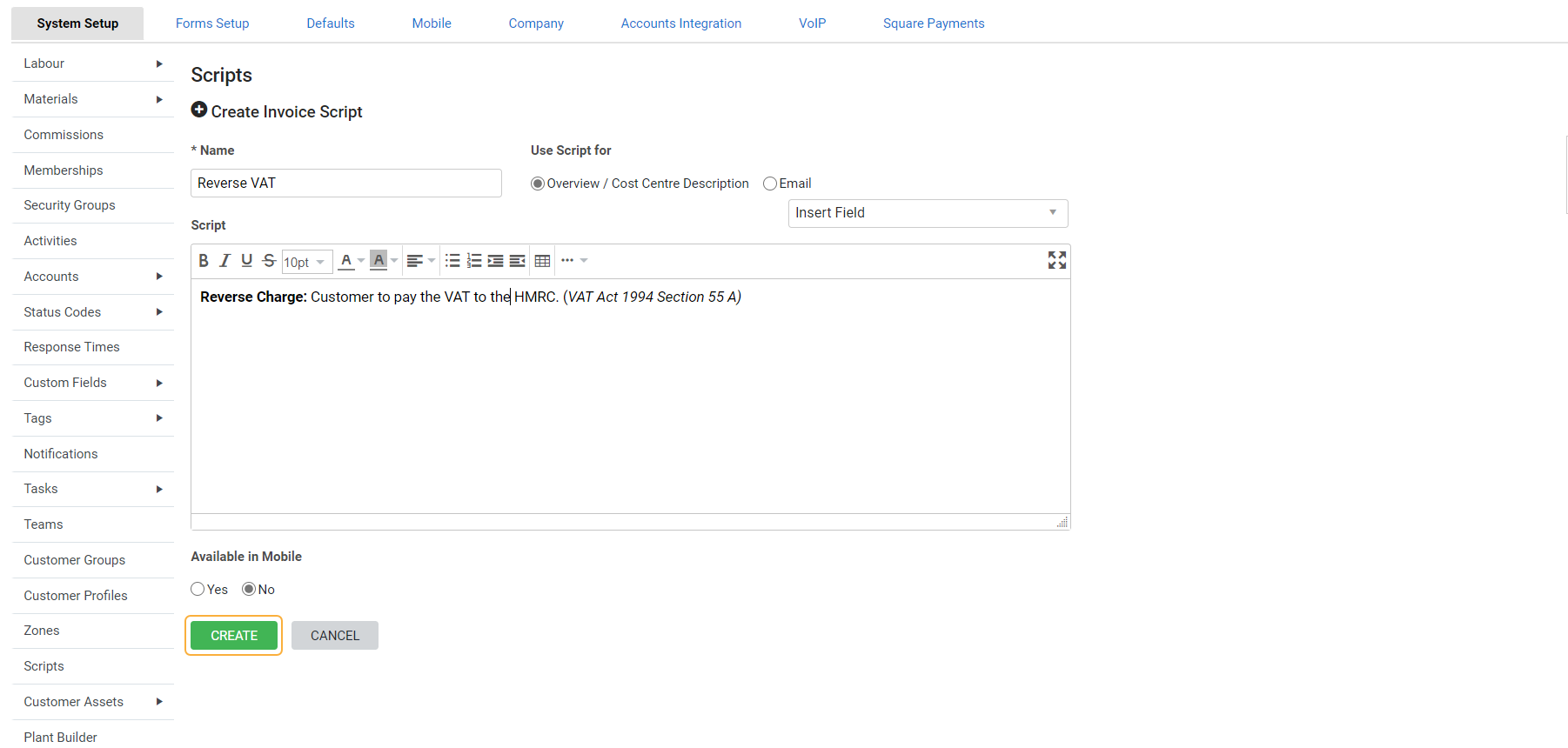

To create the reverse charge note as a script:

- Go to System

> Setup > System Setup > Scripts > Invoice.

> Setup > System Setup > Scripts > Invoice. - Click CREATE SCRIPT.

- Enter a Name for the script such as Reverse charge VAT note.

- In the script field enter the note.

- For example - Reverse Charge: VAT Act 1994 Section 55A applies

- Click CREATE.

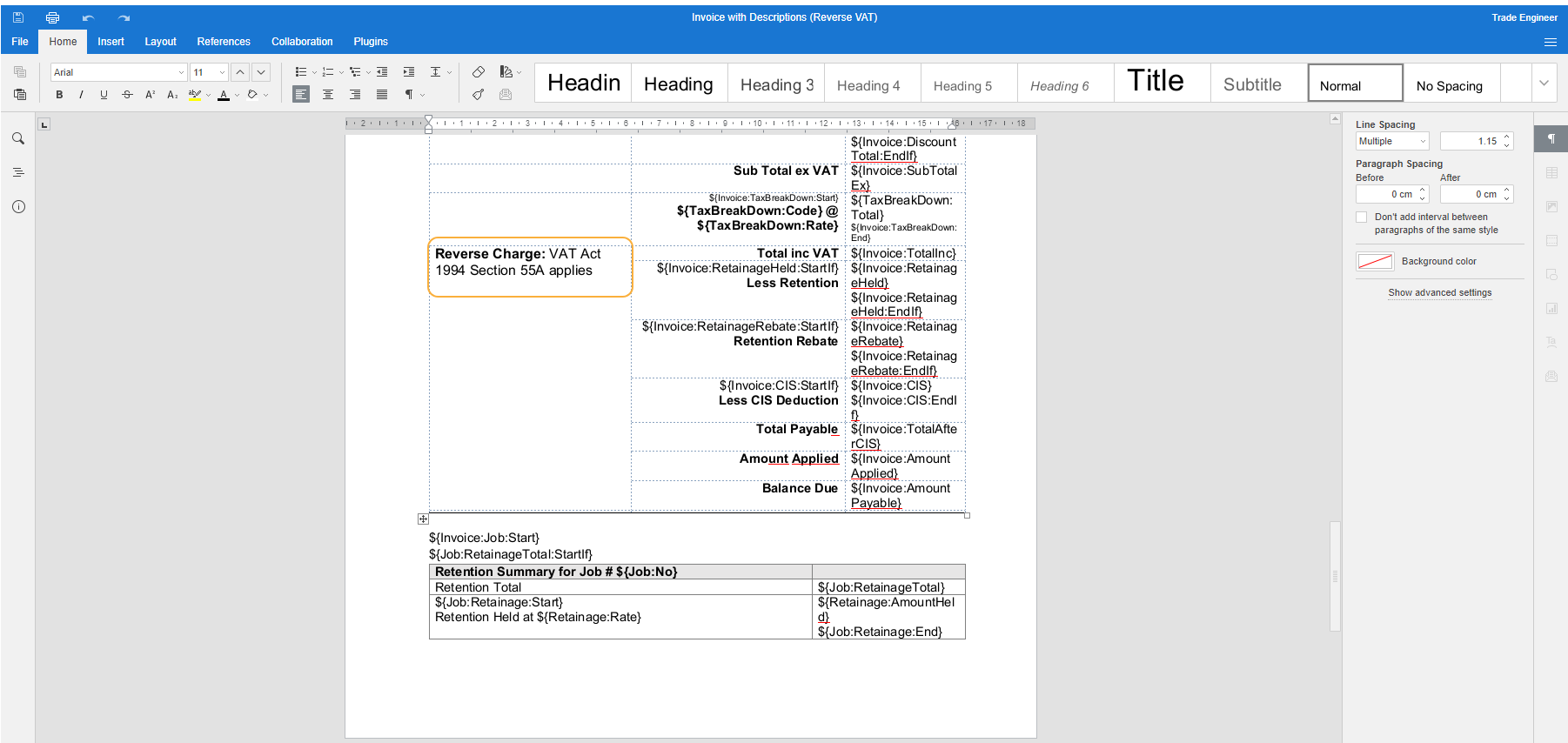

To add a reverse charge note to a Form Builder template:

- Go to System

> Setup > Form Setup > Invoice > Form Builder Templates > CREATE NEW TEMPLATE.

> Setup > Form Setup > Invoice > Form Builder Templates > CREATE NEW TEMPLATE. - Select the template you need the reverse charge VAT form to be based on.

- Click CONTINUE.

- Update the Template Name to identify it as an invoice that includes reverse charge.

- For example - Claim itemised w-Qty Reverse Charge Applies

- In the section of the template where the ${Invoice:FootNote} field appears replace this field with the reverse charge note.

- Reverse Charge: VAT Act 1994 Section 55A applies

- Click Save and Finish.

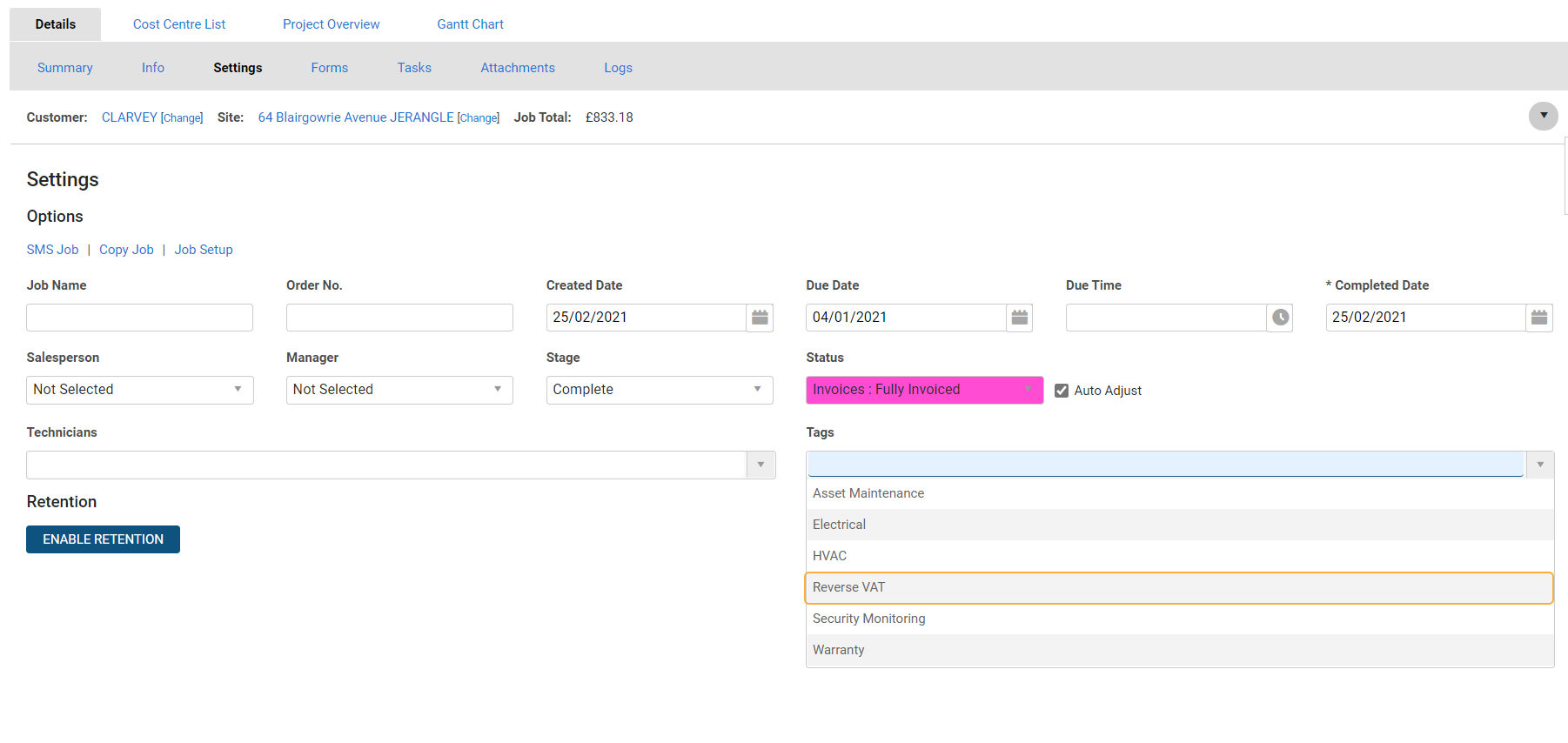

Create a reverse charge project tag

Create a reverse charge project tag to make reporting on reverse charge tax jobs and invoices easier and streamline this process.

To create a reverse charge project tag:

- Go to System

> Setup > Tags > Project Tags.

> Setup > Tags > Project Tags. - Click CREATE TAG.

- Enter a name for the tag such as Reverse Charge VAT Applies.

- Click CREATE.

You can apply this tag to quotes and jobs that include reverse charge on the Quote / Job Details page when first creating the work. Alternatively, you can apply the tag to an existing quote or job from the Details > Settings tab.

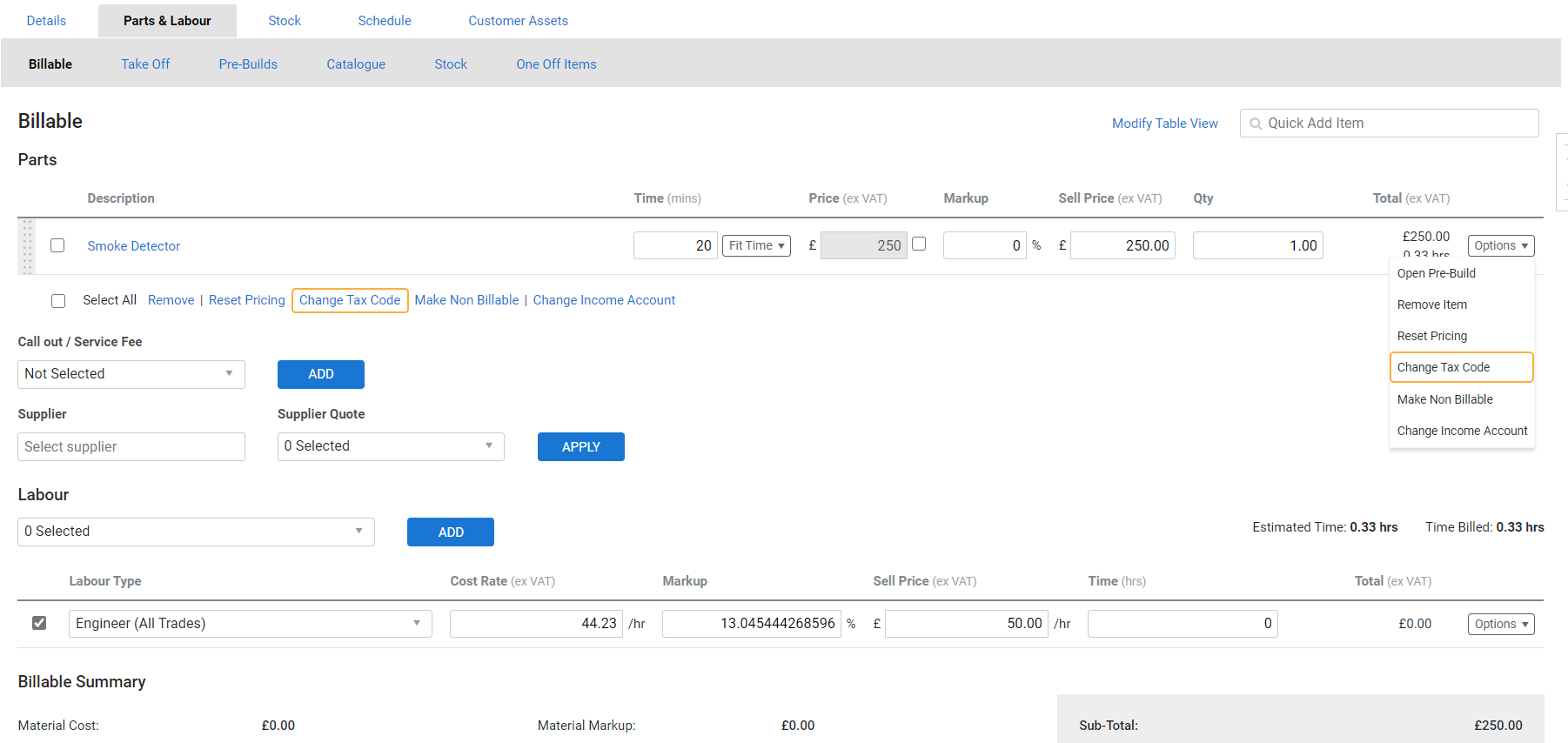

Assign reverse charge tax to individual items

You can choose to calculate and apply reverse charge VAT to individual items, cost centres or the entire quote or job.

If reverse charge VAT applies to specific the parts and labour, you can assign a tax code created for reverse charge:

- Open or create the quote or job.

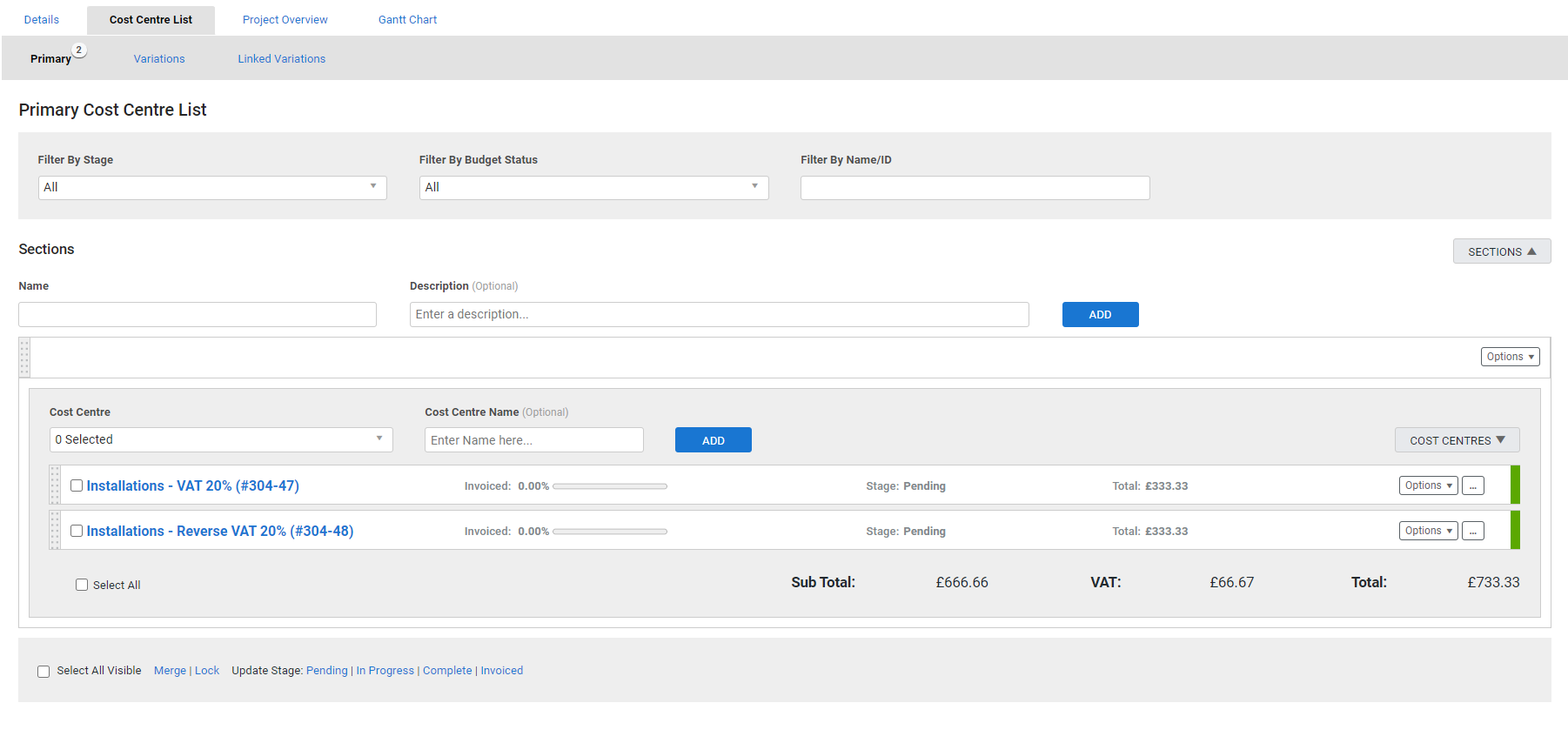

- If it is a project quote / job go to Cost Centre List and open the relevant cost centre.

- Click Parts & Labour.

- Add materials and labour as required.

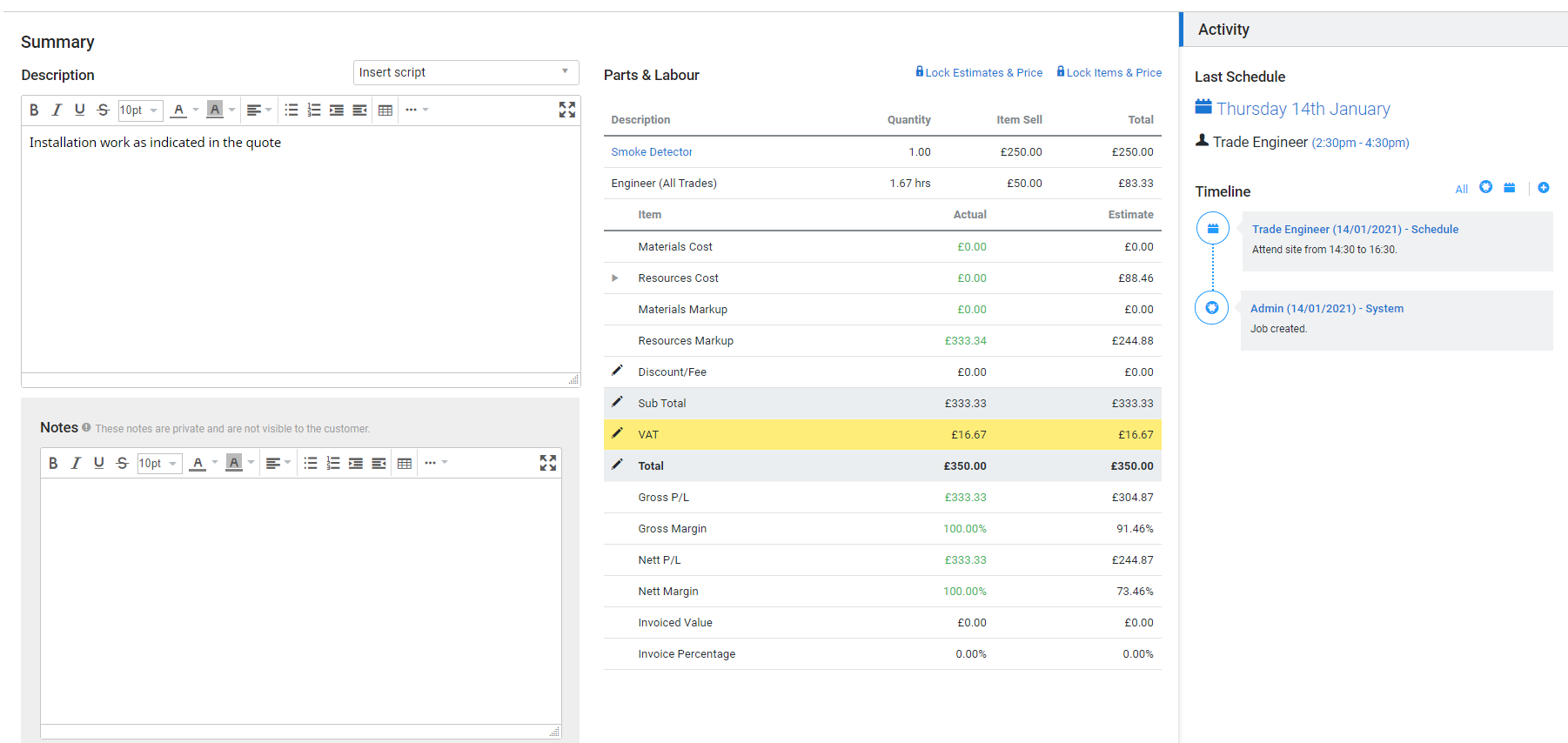

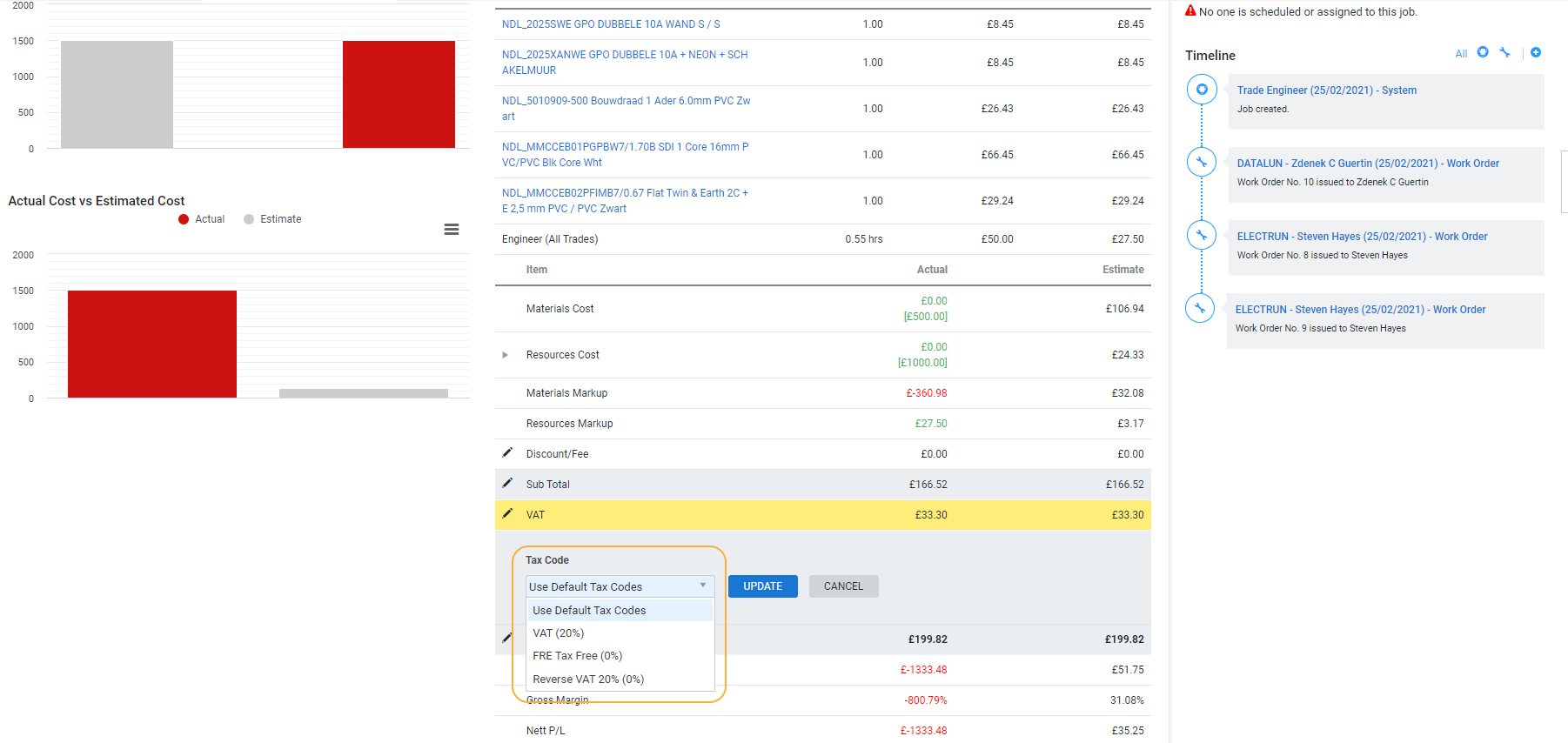

- Go to Details > Summary and note down the VAT value.

- Go to Parts & Labour, select the items that reverse charge VAT applies to and click Change Tax Code. Alternatively, click Options next to an individual material, or a labour rate and click Change Tax Code.

- Select the tax code created for reverse charge.

- Click SAVE.

- Go to Details > Summary and note down the new VAT value. Deduct this value from the original VAT value. This determines the total reverse charge VAT.

- For example - The original VAT value is £66.67 after applying the reverse charge tax code it is £16.67. = £66.67 - £16.67 = £50 which is the domestic reverse charge VAT to be paid directly to the HMRC.

Assign reverse charge tax to a cost centre

If reverse charge VAT applies to all of the parts and labour on a cost centre, you can assign a tax code created for reverse charge to the cost centre:

- Open or create the quote or job.

- Add parts and labour as required.

- Go to Details > Summary and note down the VAT value.

- If it is a project quote / job go to Cost Centre List and open the cost centre that reverse charge VAT applies to.

- Click the edit icon next to the tax code.

- Select the reverse charge tax code.

- Click Update. Reverse charge VAT is applied to all of the parts and labour in this cost centre.

- Click SAVE.

- Go to Cost Centres > Details > Summary and note down the new VAT value. Deduct this value from the original VAT value. This determines the total reverse charge VAT.

- For example - The original VAT value is £133.34 after applying the reverse charge tax code it is £66.67. = £133.34 - £66.67 = £66.67 which is the domestic reverse charge VAT to be paid directly to the HMRC.

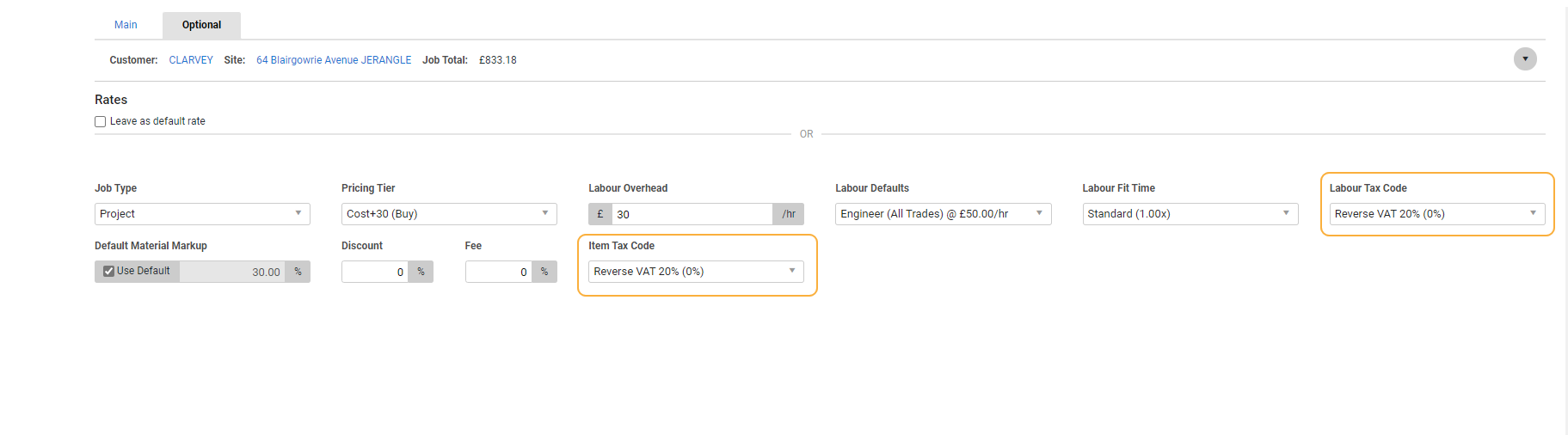

Assign reverse charge tax to a quote or job

If reverse charge VAT applies to all of the parts and labour on a job, you can assign a tax code created for reverse charge to the cost centre:

- Open or create the quote or job.

- Add parts and labour as required.

- Go to Details > Summary and note down the VAT value. This is the Reverse Charge VAT value.

- Go to Details > Settings > Quote / Job Setup > Options.

- Under Part Tax Code and / or Labour Tax Code select the reverse charge tax code.

- Click NEXT.

- Click SAVE.

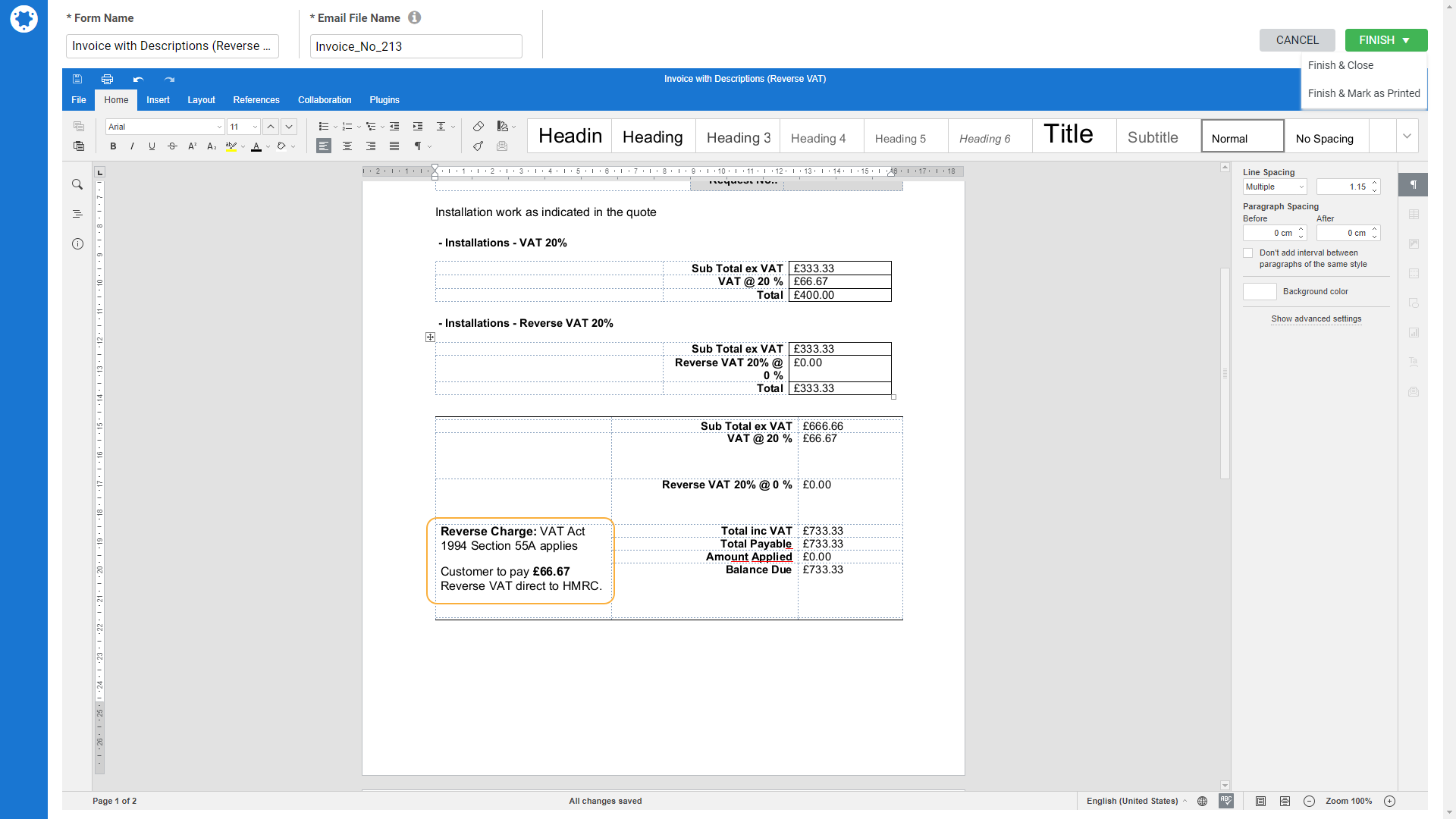

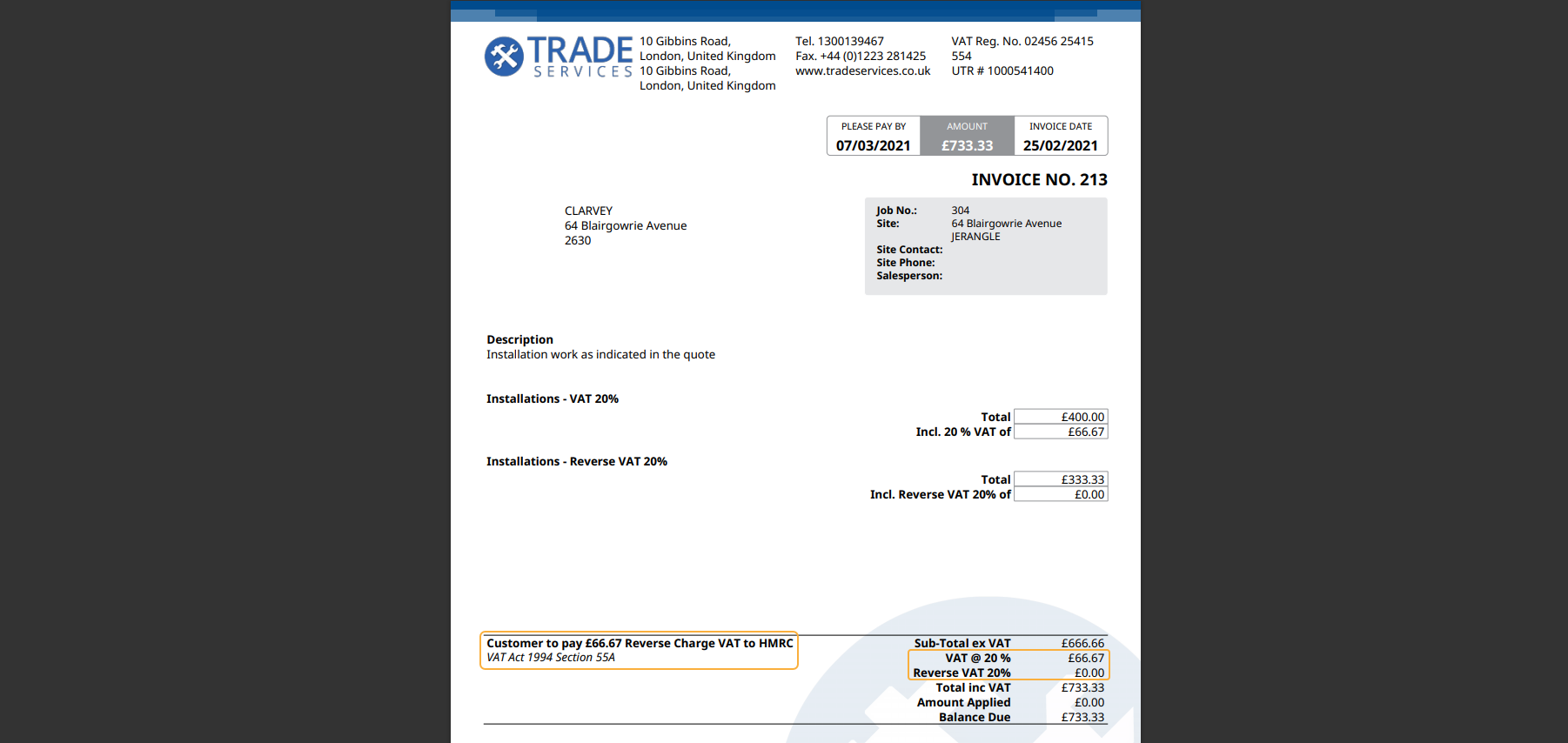

Displaying reverse charge VAT on invoices

Once you have applied and calculated domestic reverse charge VAT on your job you need to ensure that the value appears on your invoice form.

To add the reverse charge value to an invoice form:

- Open the job with reverse charge VAT.

- Click Save and Finish.

- Click Invoice Job.

- If you set your reverse charge note to appear on all invoices it will be populated in the Footnote section.

- Learn more in Add reverse charge note to invoice templates.

- If you have created a script for your reverse charge note, in the Footnote section, select the reverse charge script from Insert Script drop-down.

- Enter the reverse charge value next to the reverse charge note.

- For example - Reverse Charge: VAT Act 1994 Section 55A applies. Customer to pay £66.67 Reverse VAT direct to HMRC.

- Click FINISH.

- Under Templates select the required form template.

- Click VIEW to preview the invoice form.

- Close the preview and click EMAIL to send the invoice to the customer.

To add the reverse charge value to a Form Builder invoice form:

- Open the job with reverse charge VAT.

- Click Save and Finish.

- Click Invoice Job > FINISH.

- Under Templates select the reverse charge form builder template.

- Click View > EDIT.

- Enter the reverse charge value next to the reverse charge note.

- For example - Reverse Charge: VAT Act 1994 Section 55A applies. Customer to pay £66.67 Reverse VAT direct to HMRC.

- Click FINISH.

- Click EMAIL to send the invoice to the customer.

Reporting on reverse charge for CIS registered construction businesses

Reporting on reverse charge for CIS registered construction businesses

If you switch to an accounting package that works with the reverse charge feature, or your account package is made compatible, you will need to amend work orders and contractor invoices. You can use the following reports to help identify which records need to be updated to make use of the updated feature.

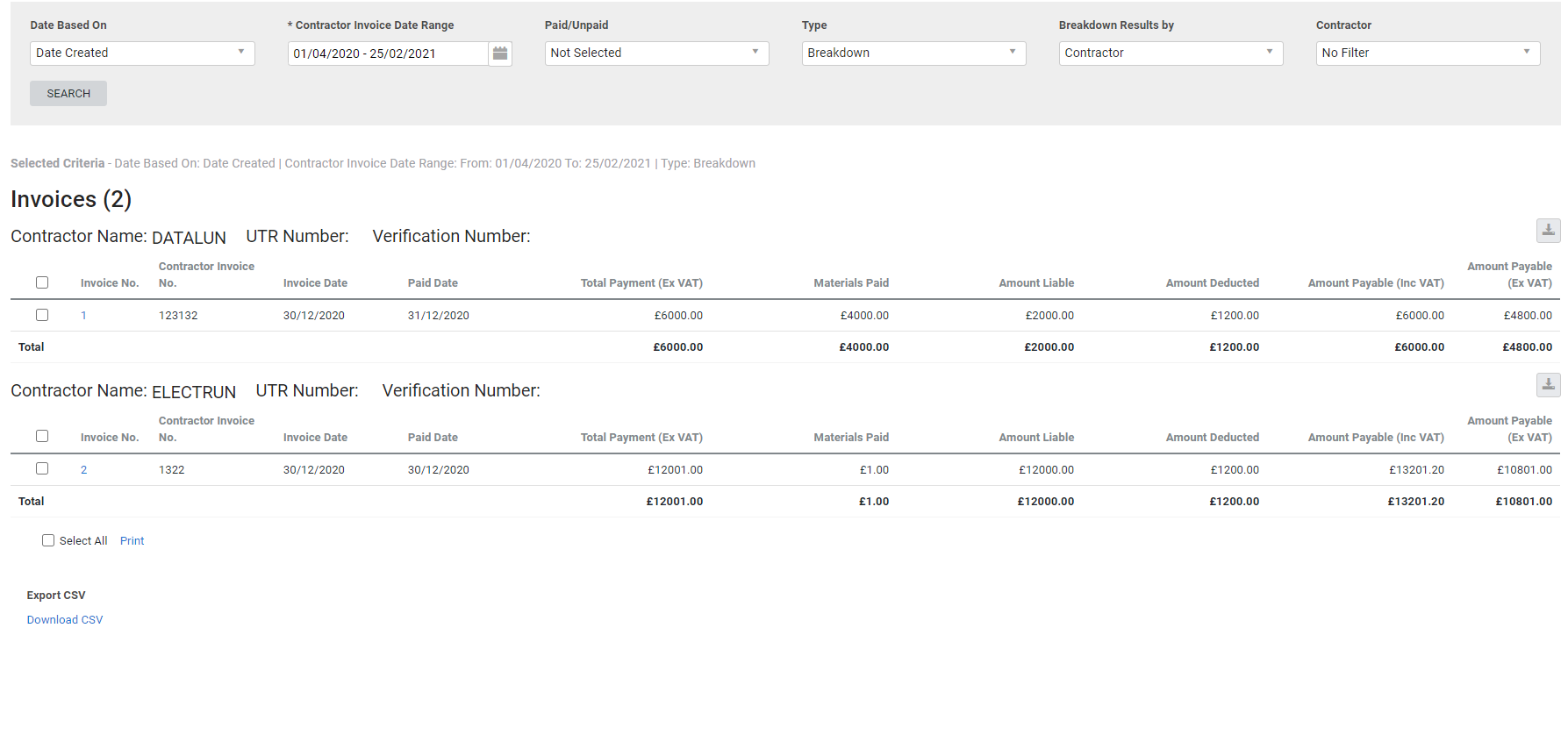

CIS Monthly Returns

Use the CIS Monthly Returns report to display contractor invoices that are generated within a specific period. Most contractors who are CIS registered will require reverse charge tax applied to their work orders and invoices.

- Go to Reports > View Reports > Contractors > CIS Monthly Returns.

- Select the Contractor Invoice Date Range.

- Set the Type to Breakdown.

- Click SEARCH.

- Review the list of contractor invoices for the period.

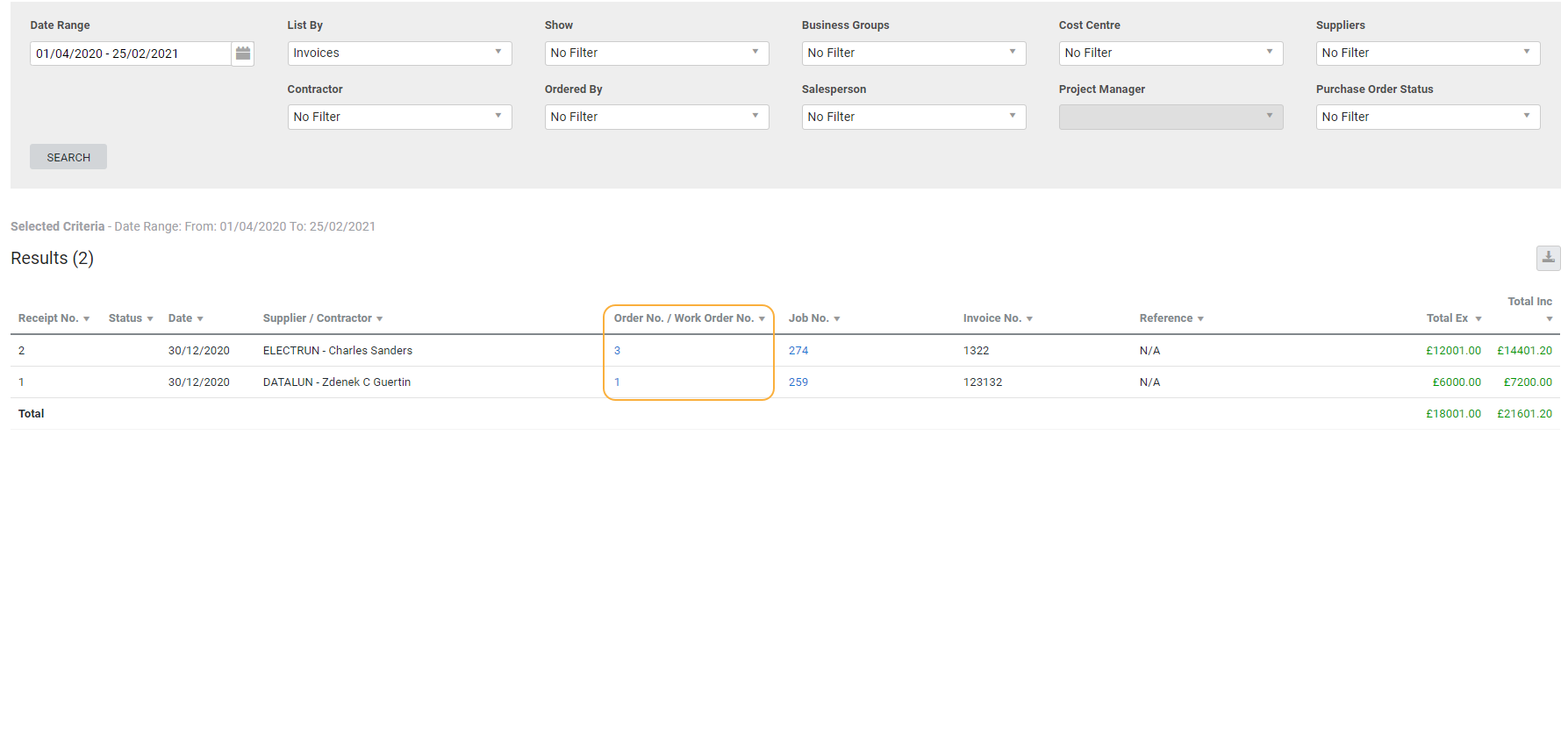

Supplier Purchases Report

Use the Supplier Purchases Report to identify which work orders need updating and which jobs they are associated with.

To run the report:

- Go to Reports > View Reports > Suppliers > Supplier Purchases.

- Select the Date Range.

- Under Show select Contractors.

- Click SEARCH. The report displays with their invoices associated jobs generated for the period.

- Click a work order number to open a contractor job. Enter a note in the Description to indicate that this work order includes reverse charge tax.

Reporting for subcontractors working for a CIS registers construction business

Reporting for subcontractors working for a CIS registers construction business

If you switch to an accounting package that works with the reverse charge feature, or your account package is made compatible, you will need to amend jobs and customer invoices. You can use the following reports to help identify which records need to be updated to make use of the updated feature.

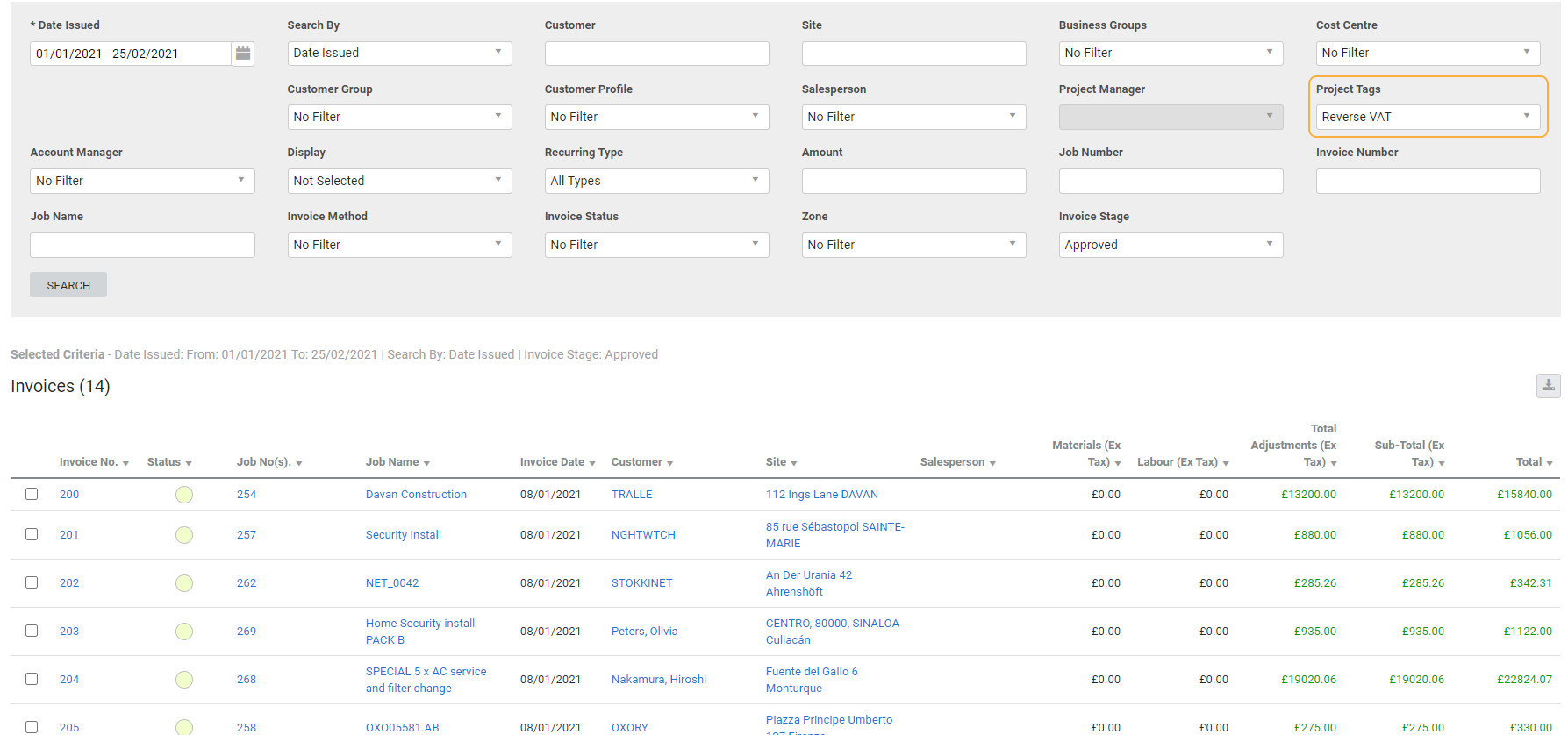

To make reporting on jobs and invoices easier, create and apply a reverse VAT project tag. Learn more in Create a reverse charge project tag.

Sales Invoice Report

Use the sales invoice report with the project tag filter selected to find all jobs invoiced with reverse VAT.

To run the report:

- Go to Reports > View Reports > Sales > Sales Invoices.

- Set the Date Issued to the relevant date range.

- Under Project Tags select the reverse VAT tag.

- Click SEARCH.