Last Updated: December 15 2025

Overview

Keep track of your actual material and labour costs against your estimated budget and make forecast changes to your current budget to account for any changes in your project in the Project Overview. Learn about the Projected tab in How to Use Project Overview Projected. Learn more about the Production tab in How to Use Project Overview Production Control.

You can also:

- Access any invoices, purchase orders and work orders associated with the project

- Set milestones as parts of your project are completed

- Review metrics of the project such as invoiced and invoiced profit against actual material and labour costs.

Required setup

Required setup

In order to view content or perform actions referred to in this article you need to have the appropriate permissions enabled in your security group. Go to System![]() > Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

> Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

Invoices

Invoices

View all invoices created for this project job. You can then apply payments individually or in bulk.

Learn more about invoicing projects in How to Create a Progress Claim.

Purchase orders

Purchase orders

View all the catalogue purchase orders created for this job.

Learn more about ordering materials for a project job in How to Create a PO From Within a Job.

Contractor jobs

Contractor jobs

View all the contractor work orders created for this project job.

Click a contractor work order to edit it. To receipt a contractor work order, click Options > Receipt.

To update the contractor work order status, select the check boxes for each contractor work order, then select the Update Status, and click Update.

Learn more about contractor work orders in How to Manage Contractor Work Orders.

View income

View income

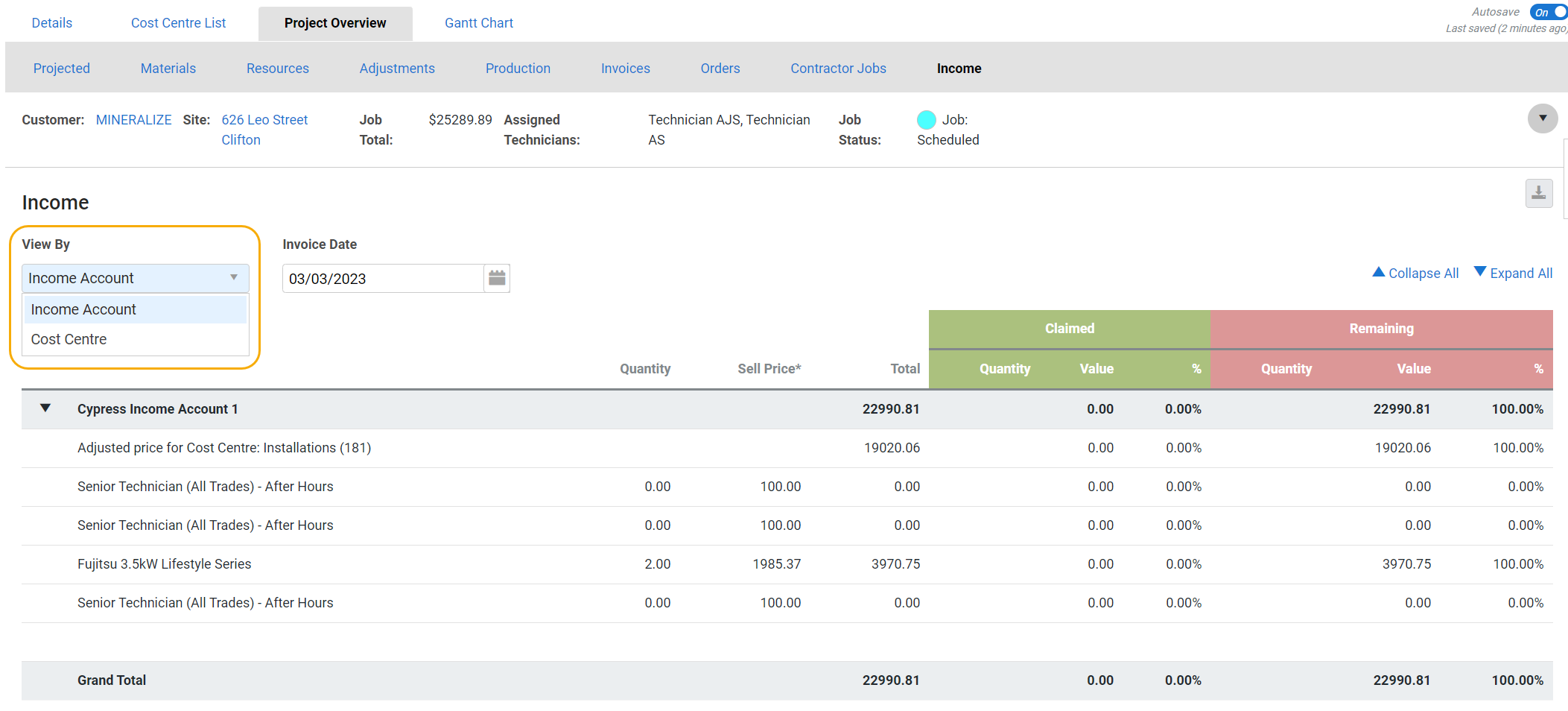

Use the Income tab to view which items are going to what income account and a running total of values going to each income account.

You can view income by Income Account or Cost Centre.

By default, Include Accruals and Deferrals is selected.

Enter an Invoice Date to see values invoiced up to and including the selected date.

Click the ![]() icon to download the table as a CSV.

icon to download the table as a CSV.

The table displays each billable item including the items that are not invoiced.

Income Account View

The Income Account view groups items by income account with the following columns:

| Item name | Displays the name of the catalogue item, labour rate, pre-build, service fee or one-off item. |

| Quantity | Displays the total quantity of the item added to the job. |

| Sell Price | Unit price of each item excluding tax. |

| Total price | Total sell price of the item excluding tax. |

| Claimed, Deferred and Accrued Revenue Quantity |

The quantity of the item that is invoiced within the selected date range. Clear the check box to exclude accrued and deferred revenue. |

| Claimed, Deferred and Accrued Revenue Value |

Total value of the item invoiced within with selected date range, excluding tax. Clear the check box to exclude accrued and deferred revenue. |

| Claimed, Deferred and Accrued Revenue Percentage |

Total percentage of the item invoiced within the selected date range. Clear the check box to exclude accrued and deferred revenue. |

| Remaining Quantity | The quantity of the item pending to be claimed. |

| Remaining Value | The total value of the item pending to be invoiced, excluding tax. |

| Remaining Percentage | The total percentage of the item pending to be invoiced. |

Cost Centre View

The Cost Centre view groups items by section, then cost centre and income account with the following columns:

| Item name | Displays the name of the catalogue item, labour rate, pre-build, service fee or one-off item. |

| Quantity | Displays the total quantity of the item added to the Job. |

| Sell Price | Unit price of each item excluding tax. |

| Total price | Total sell price of the item excluding tax |

| Claimed, Deferred and Accrued Revenue Quantity | The quantity of the item that is invoiced within the selected date range. |

| Claimed, Deferred and Accrued Revenue Value | Total value of the item invoiced within the selected date range, excluding tax. |

| Claimed, Deferred and Accrued Revenue Percentage | Total percentage of the item invoiced within the selected date range. |

| Remaining Quantity | The quantity of the item pending to be claimed. |

| Remaining Value | The total value of the item pending to be invoiced, excluding tax. |

| Remaining Percentage | The total percentage of the item pending to be invoiced. |

Cost centres with an adjusted price display an Adjusted Price line item with no values. Income values cannot be calculated for cost centres with an adjusted price.

Learn more in the Learning Toolbox

Learn more in the Learning Toolbox

For additional training, complete an interactive material in the Simpro's Learning Toolbox. Learn more in About Simpro's Learning Toolbox.