Last Updated: December 12 2025

How to Manage Accrual of Revenue

Overview

Accrual basis accounting allows businesses to recognises revenue when costs such as parts and labour are incurred, and not when the money actually changes hands.

For example, you might have committed to do a large project that is due to receive a large bulk payment in several months time, but over the course of the next few months you need to hire contractors and pay suppliers for parts incurring costs. An accrual could be created now to account for the future payment and reconcile the costs currently being incurred.

Required setup

Required setup

In order to view content or perform actions referred to in this article you need to have the appropriate permissions enabled in your security group. Go to System![]() > Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

> Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

Before performing the steps detailed below, ensure that this part of your build is set up correctly. The relevant steps to set up the features and workflows detailed in this article can be found here:

Create an accrual in a job

Create an accrual in a job

To create an accrual in a job:

- Open a job or create a new one as required.

- Open the relevant cost centres.

- Add parts and labour, stock, create work orders and schedule employees as required. Each item can incur costs that can be accounted for by the accrual.

- Go to Details > Accruals & Deferrals, or go to Project Overview > Accruals & Deferrals.

- Ensure you are on the Accrual Revenue sub-tab.

- Click CREATE ACCRUAL REVENUE.

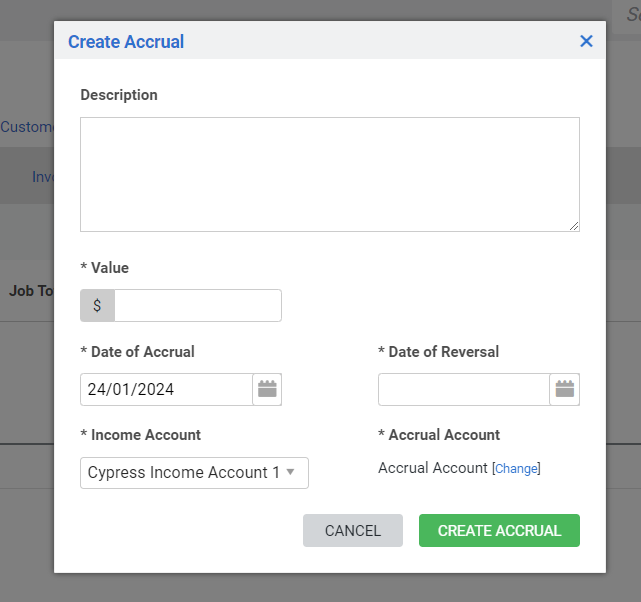

- Add a Description to detail which part of the job you’re accounting for.

- Enter the Value of the accrual excluding tax.

- Select the Date of Accrual to set the date that you want to account for the revenue.

- Under Date of Reversal, enter the date that you will be paid the revenue being accrued. The value of this accrual is revered automatically on this date.

- The Income Account and Accrual Account are inherited from the cost centre. Change accounts as required.

- If you are creating an accrual from the Project Overview, select the relevant Cost Centre.

- If you have Category Tracking enabled, select the relevant Category.

- If you have business group tracking enabled the business group associated with the cost centre is assigned to the accrual.

- Click CREATE ACCRUAL.

Note that if an accrual is created in error it can be deleted even if it has been sent to the accounting platform. The journal entry is not deleted in your accounting package when the accrual is deleted in Simpro Premium. Ensure to reconcile your accounting package manually.

Export accruals

Export accruals

Note that accrual and deferral revenue can only be posted to Xero or QuickBooks. It is not currently available for other accounting packages.

To transfer Accrual & Deferral Journals to your accounting package:

- Go to Utilities > Xero / QuickBooks depending on your integrated accounting link.

- Under Transaction Type select Accrual & Deferral Journals.

- Select the relevant journals to be transferred.

- For accruals the following information is sent:

- The Description prefixed by "Job No. XXXX-YY (Deferral Revenue)" Where XXXX represents the job number, and YY represents the cost centre ID

- A positive amount of the Value is journaled to the accrual account

- A negative amount of the Value is journaled to the revenue account

- For accrual reversals the following information is sent:

- The Description prefixed by "Job No. XXXX-YY (Deferral Revenue)" Where XXXX represents the job number, and YY represents the cost centre ID

- A negative amount of the Value is journaled to the accrual account

- A positive amount of the Value is journaled to the revenue account

- For a deferrals the following information is sent:

- The Description prefixed by "Job No. XXXX-YY (Deferral Revenue)" Where XXXX represents the job number, and YY represents the cost centre ID

- A negative amount of the Value is journaled to the deferral account

- A positive amount of the Value is journaled to the revenue account

- For deferral reversals the following information is sent:

- The Description is sent to the accounting platform prefixed by "Job No. XXXX-YY (Deferral Reversal Revenue)" Where XXXX represents the job number, and YY represents the cost centre ID

- A positive amount of the Value is journaled to the deferral account

- A negative amount of the Value is journaled to the revenue account

- Click Process Selected to send the journals to your accounting package, otherwise click Mark as exported to remove the journals from the list without transferring them.

Reporting on deferrals

Reporting on deferrals

Deferrals can be seen in jobs in the Project Overview > Income tab, Job WIP Report, the Job Activity Report, the scheduled versions of these reports, the Accruals and Deferrals Report and the Transactions Ready to Export Report.

Learn more in How to Use the Project Overview in Jobs, Job WIP Report, Job Activity Report, How to Schedule Reports, Accruals and Deferrals Report and the Transactions Ready / Waiting for Export Report.