Last Updated: December 12 2025

How to Manage Deferral of Revenue

Overview

Deferral revenue is used to account for costs that haven’t been incurred yet, but have already been paid for.

For example, you might have a subscription fee that you charge a customer for 12 months of work upfront. But the actual costs for the labour provided might not be paid until the coming months. The job might be created and invoiced immediately but deferrals are created for future months when the actual work is done and the costs are incurred.

Required setup

Required setup

In order to view content or perform actions referred to in this article you need to have the appropriate permissions enabled in your security group. Go to System![]() > Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

> Setup > Security Groups and access your security group to update your permissions. The relevant security group tab and specific permissions for this article can be found here:

Before performing the steps detailed below, ensure that this part of your build is set up correctly. The relevant steps to set up the features and workflows detailed in this article can be found here:

Create a deferral in a job or invoice

Create a deferral in a job or invoice

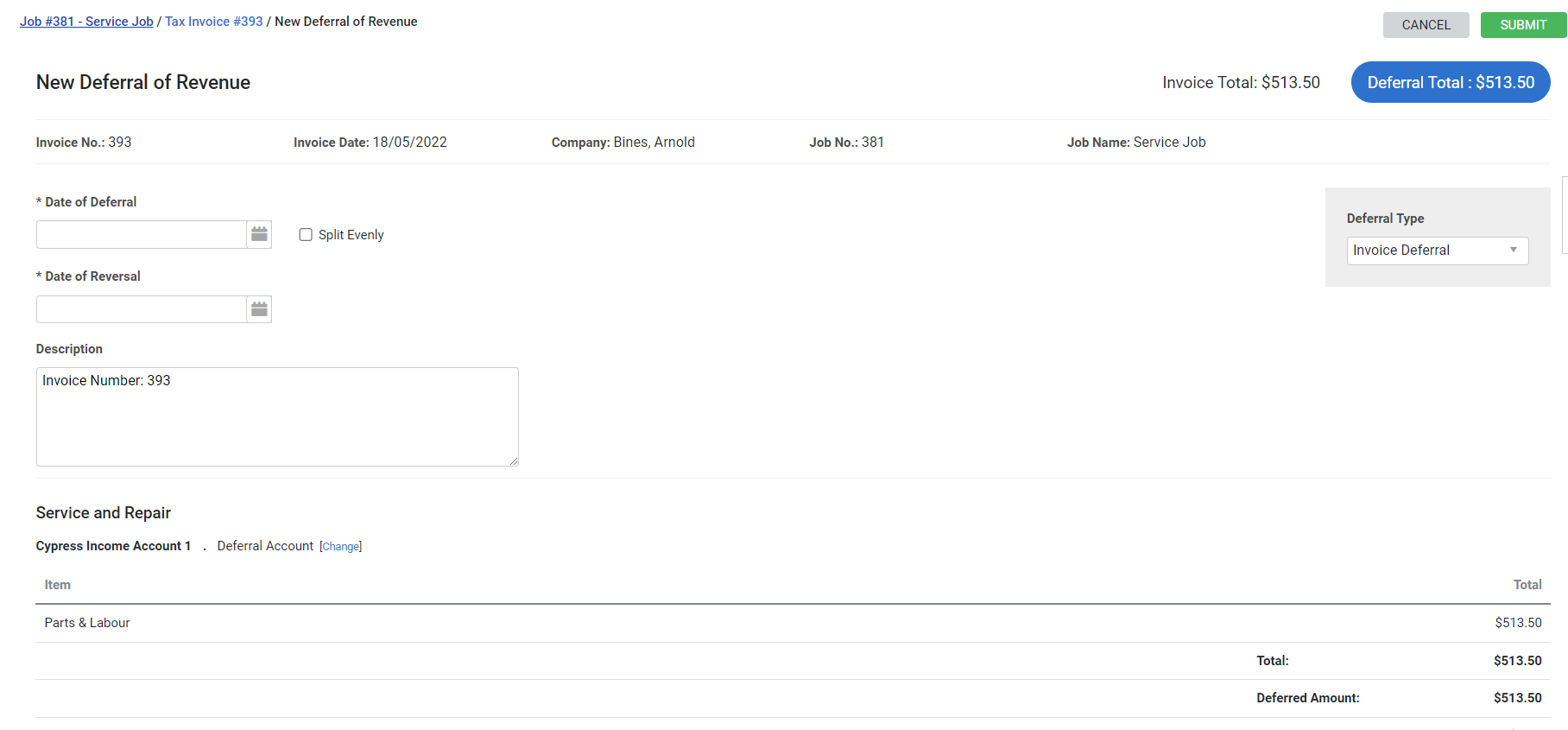

To create a deferral in a job or invoice:

- Open a job that has been invoiced or open the invoice. The invoice must be approved.

- If creating a deferral from the job, open the cost centre and go to Details > Accruals & Deferrals > Deferral Revenue. Alternatively go to Project Overview > Accruals & Deferrals > Deferral Revenue.

- If creating a deferral from the invoice click Deferrals.

- Note that Deferrals only appear if the job being invoiced has at least one cost centre that includes a deferral account. Go to System > Setup > Accounts > Cost Centres to set cost centre accounts.

- Click CREATE DEFERRAL REVENUE.

- Select the Date of Deferral to set the date that you want to account for the revenue.

- Select the Date of Reversal as the end of the period that you want to defer the revenue.

- Enter a Description to appear in the accounting link when you are transferring the deferral and in your accounting package.

- If you want the deferral to be divided among multiple occurrences select Split Evenly, select how often you want the deferral to Repeat and enter the number of Occurrences if you want the deferrals to End After.

- For example if you charge 12 months of work upfront, but want to defer the revenue so that you’re only accounting for a portion of the revenue once a month for 12 months, you would set the deferral to Repeat Every '1' Months and End After '12' Occurrences.

- Alternatively, if you want to create multiple deferrals with different values, or only defer a specific portion of the invoice under Deferral Type select Section Break Down and set the % of the invoice or Deferred Amount to be included in this deferral.

- If you are invoicing a project job you can set the % or Deferred Amount for each section.

- If you are creating a deferral from the Project Overview, select the relevant Cost Centre.

- If you have Category Tracking enabled, select the relevant Category.

- If you have business group tracking enabled the business group associated with the cost centre is assigned to the deferral.

- Click Submit.

You can deselect Hide Reversals to see all deferrals that have been reversed.

Export deferrals

Export deferrals

Note that accrual and deferral revenue can only be posted to Xero or QuickBooks. It is not currently available for other accounting packages.

To transfer Accrual & Deferral Journals to your accounting package:

- Go to Utilities > Xero / QuickBooks depending on your integrated accounting link.

- Under Transaction Type select Accrual & Deferral Journals.

- Select the relevant journals to be transferred.

- For accruals the following information is sent:

- The Description prefixed by "Job No. XXXX-YY (Deferral Revenue)" Where XXXX represents the job number, and YY represents the cost centre ID

- A positive amount of the Value is journaled to the accrual account

- A negative amount of the Value is journaled to the revenue account

- For accrual reversals the following information is sent:

- The Description prefixed by "Job No. XXXX-YY (Deferral Revenue)" Where XXXX represents the job number, and YY represents the cost centre ID

- A negative amount of the Value is journaled to the accrual account

- A positive amount of the Value is journaled to the revenue account

- For a deferrals the following information is sent:

- The Description prefixed by "Job No. XXXX-YY (Deferral Revenue)" Where XXXX represents the job number, and YY represents the cost centre ID

- A negative amount of the Value is journaled to the deferral account

- A positive amount of the Value is journaled to the revenue account

- For deferral reversals the following information is sent:

- The Description is sent to the accounting platform prefixed by "Job No. XXXX-YY (Deferral Reversal Revenue)" Where XXXX represents the job number, and YY represents the cost centre ID

- A positive amount of the Value is journaled to the deferral account

- A negative amount of the Value is journaled to the revenue account

- Click Process Selected to send the journals to your accounting package, otherwise click Mark as exported to remove the journals from the list without transferring them.

Edit and delete deferrals

Edit and delete deferrals

To delete or edit a deferral from a job:

- Go to Details > Accruals & Deferrals > Deferral Revenue.

- Alternatively go to Project Overview > Accruals & Deferrals > Deferral Revenue.

To delete or edit a deferral from an invoice go to the Deferrals tab.

Note that invoices that include deferrals cannot be deleted unless they have been reversed. If an invoice is deleted that includes reversals the reversals and deferrals are deleted as well.

If a deferral has been sent to the accounting package only the date of reversal can be edited. All other fields become read only.

Note that if a deferral is created in error it can be deleted even if it has been sent to the accounting platform. The journal entry is not deleted in your accounting package when the deferral is deleted in Simpro Premium. Ensure to reconcile your accounting package manually.

Retention and deferrals

Retention and deferrals

When an invoice has retention applied to it the retention appears on the deferral as an addition in the subtotal, but the price of the parts and labour is not affected.

When retention has been applied to an invoice with multiple cost centres, the retention is apportioned to the cost centres and their relevant income accounts. This appears as Retentions underneath the subtotal line of each cost centre.

The value which can be deferred in sections with retention is the total invoiced price of parts and labour, minus the value of the retention.

Discounts, fees, adjustments are applied prior to the calculation of the retention.

Note that as deferrals are always exclusive of tax, if the retention is calculator including tax, the tax portion of the retention is removed prior to the retention for the cost centre being calculated.

Retention claims are not impacted by deferrals.

Reporting on deferrals

Reporting on deferrals

Deferrals can be seen in jobs in the Project Overview > Income tab, Job WIP Report, the Job Activity Report, the scheduled versions of these reports, the Accruals and Deferrals Report and the Transactions Ready to Export Report.

Learn more in How to Use the Project Overview in Jobs, Job WIP Report, Job Activity Report, How to Schedule Reports, Accruals and Deferrals Report and the Transactions Ready / Waiting for Export Report.